Tax Year: 2014

Owner Name: _______________________________________

Address: ___________________________________________

Assessment Code: ___________________________________

County: ____________________________________________

Supplies

Value $ ____________ Report the total value of supplies on hand as of January 1, 2014.

Supplies are consumable materials used to conduct business but not intended for sale or lease. Examples include, but are not limited to, offi ce supplies

(paper, toner cartridges, etc.), restaurant and bar supplies (napkins, disposable dishes, etc.), cleaning supplies, shop supplies, doctor/dentist supplies, motel/

hotel supplies (paper products, personal soaps, etc.), and beauty and barbershop supplies (dyes, caps, etc.).

Professional Libraries

Number of items _________________ Report the number of items in your professional library as of January 1, 2014.

Professional Libraries include law, medical, account and parts books, or instructional videos.

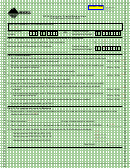

Furniture, Fixtures and Miscellaneous Equipment Instructions

●

All personal property owned by a business needs to be reported.

●

Report each item or group of common items.

●

Report small items, such as handheld tools, as a lump sum per year acquired. If this cannot be determined, you may provide a number that refl ects the

average number of tools you usually acquire in a year.

●

If you are unsure of the year acquired, provide your best estimate.

●

Detailed reporting assists us in applying the maximum appropriate depreciation.

●

Attached is a list of the personal property items on fi le for the identifi ed business and owner (if previously reported).

●

If you operate at more than one location and have reported in the past, data for all locations with a common assessment code is displayed on this form.

●

If you operate at more than one location and have not reported in the past, complete a separate form for each location.

●

You may provide an asset listing in addition to a completed reporting form. However, an asset listing is not a substitute for the form.

●

All business equipment, even if fully depreciated on your federal income tax records, must be reported. The acquired/installed cost and acquired year

reported on this form should agree with the acquired cost and year reported on your federal income tax return.

●

Report the cost of intangible software separately.

Use the Furniture, Fixtures and Miscellaneous Equipment table to report the following types of equipment.

●

Computer Systems / Computerized Equipment / Video Gambling / Video Game Machines / Intangible Software / ATMs not built-in

●

Accounting, Addressing Machines / Calculators / Cash Registers / Electronic, Fax, Offi ce, Photocopy, Postage, Time Recording, Transcribing and Vending

Machines / Jukeboxes / Typewriters / One Hour Photo Processors

●

Intercom Equipment / Microphones and Sound Equipment / Telephone Systems, including PBX type systems

●

Specialized Medical and Dental Equipment, including hand tools, drills, etc., but not medical chairs and tables

●

Apartment, Rental, Hotel and Motel Furniture, including hotel-motel linens / Nursing Home Furniture, including equipment and fi xtures

5

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14