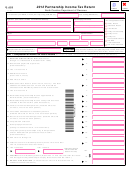

Instructions For Form D-403a - Partnership Income Tax Return - 2012 Page 2

ADVERTISEMENT

Page 2, D-403A, Web, 11-12

G. Estimated income tax. - No estimated income tax

Part 1 - Computation of Income Tax Due or Refund

payment is required of a partnership; however, if the partnership

makes any prepayments of tax, include the prepayment

Line Instructions

on Line 14. A resident individual partner who meets the

statutory requirements must file estimated tax on Form NC-40.

Important: If the partnership operated only in North Carolina and

(See Individual Income Tax Instructions for Form D-400 for

had no nonresident partners, complete only Lines 4 and 6, Part

information on the requirements for paying estimated income

1 (and Lines 13 or 14 if any payments were made), Part 3A, and

tax.)

A nonresident individual partner is not required to pay

Part 4.

estimated tax on his distributive share of partnership income.

Line 1 - Enter on Line 1 the total income or loss from Schedule

H. Tax Credits. - All tax credits allowed to individuals are allowed

K, Federal Form 1065. The total income or loss is the combined

to partnerships with the following exceptions:

total of lines 1 through 11 of Schedule K.

(1) Credit for childcare and certain employment-related

Line 2 - Enter the amount of salaries, interest, or other “guaranteed

expenses

payments” made to a partner for services or for the use of capital.

(2) Credit for the disabled

Salaries to partners and retirement payments to partners who are

(3) Credit for children

not active are treated as part of a partner’s distributive share of

(4) Credit for contributions by nonitemizers

ordinary income and must be apportioned to North Carolina on the

(5) Credit for long-term care insurance

same basis as other partnership distributive income.

(6) Credit for adoption expenses

(7) Earned Income Tax Credit

Line 4 - The following additions to income are required in calculating

(8) Credit for children with disabilities who require special

North Carolina partnership income to the extent the additions are not

education

included in income. Complete Part 4, Lines 1 through 5 and enter

the total additions on Part 1, Line 4. Allocate the total additions on

A partnership may pass through to each of its partners the partner’s

Line 4 to the individual partners in Part 3, Line 6.

distributive share of an income tax credit for which the partnership

qualifies. Any dollar limit on the amount of a tax credit applies to

Additions to income:

the partnership as a whole instead of to the individual partners.

Maximum dollar limits and other limitations that apply in determining

(1) Interest on bonds and other obligations of states and political

the amount of tax credit available to a taxpayer apply to the same

subdivisions other than North Carolina, if not included in

extent in determining the amount of tax credit for which a partnership

income

qualifies, with one exception. The exception is a limitation that the

tax credit cannot exceed the tax liability of the taxpayer.

(2) Any state, local, or foreign income tax deducted on the federal

partnership return

If there are nonresident partners whose share of tax is being paid

by the manager of the partnership, and the partnership claims a tax

(3) The federal Small Business Jobs Act of 2010 extended the

credit, complete Form D-403TC, Partnership Tax Credit Summary,

50 percent bonus depreciation through 2011. Subsequent

and include the form with the partnership return. Attach a separate

to this Act, the federal Tax Relief Act of 2010 extended

schedule showing the computation of any tax credits and the

the bonus depreciation from 50 percent to 100 percent

allocation of the credits among the partners. If claiming any credit

for qualified property acquired and placed in service after

that is limited to 50 percent of the partnership’s tax, less the sum

September 8, 2010 and before January 1, 2012. The Tax

of all other credits claimed, complete Form NC-478 and attach it to

Relief Act of 2010 also provides 50% bonus depreciation

the front of the partnership return. The partnership must provide

for qualified property placed in service after December 31,

sufficient information about the tax credits to allow the partner to

2011 and before January 1, 2013. Certain long-lived property

complete the Form NC-478 series.

and transportation property is eligible for 100% expensing if

placed in service before January 1, 2013. North Carolina

I. Attachments. - Attachments may be used in preparing the

did not adopt the bonus depreciation provisions under IRC

partnership return. The attachments must contain all required

sections 168(k) and 168(n) of these Acts. Therefore, if you

information, follow the format of the official schedules, and must

deducted the bonus depreciation under IRC sections 168(k)

be attached in the same sequence as the schedules appear on

or 168(n) on your 2012 federal partnership return, you must

the partnership return. List the partnership’s federal identification

add to income 85% of the amount deducted. This adjustment

number on each attachment.

does not result in a difference in basis of the affected assets

for State and tax purposes. Note: Any amount of the bonus

J. Specific instructions for Schedule NC K-1. - Schedule NC

depreciation added to income on your 2012 State return may

K-1 is used by the partnership to report each partner’s share of

be deducted in five equal installments over your first five

the partnership’s income, adjustments, tax credits, etc. The NC

taxable years beginning with the tax return for taxable year

K-1 must reflect the net tax paid by the partnership. Prepare

2013.

and give a Schedule NC K-1 to each person who was a partner

in the partnership at any time during the year. Schedule NC K-1

(4) Other additions to income

must be provided to each partner on or before the day on which

the partnership return is required to be filed. When reporting the

Line 6 - The following deductions from income are required in

distributive share of tax credits, provide a list of the amount and type

calculating North Carolina partnership income to the extent the

of tax credits. Any amount reported as tax paid by the manager of

deductions are included in income. The total deductions from Part

the partnership should include amounts paid with extension and by

4, Line 10 should be entered on Part 1, Line 6 and allocated to the

other partnerships, if applicable.

individual partners in Part 3, Line 7.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4