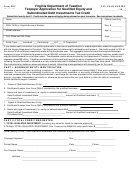

Form D-499 - Application For Tax Credit For Qualified Business Investments - 2013 Page 2

ADVERTISEMENT

Page 2

General Information

D-499

The information below does not cover all provisions of the law. See North Carolina

Web

General Statutes 105-163.010 through 105-163.015 for additional information.

8-12

A. Tax Credit - This credit is not allowed to individuals or to pass-

For investments placed initially in escrow, conditioned upon other

through entities for investments in a qualified business if a broker’s

investors’ commitment of additional funds, the date of the investment

is the date the escrowed funds are transferred to the qualified

fee or commission or other similar remuneration is paid or given

directly or indirectly for soliciting the purchase.

business venture.

Individuals - An individual who purchases the equity securities

G. Forfeiture of Credit - The credit is forfeited by the taxpayer if:

or subordinated debt of a qualified business is allowed a credit

(1) within three years after the investment was made, the taxpayer

participates in the operation of the qualified business. A

against the tax for the taxable year equal to 25% of the amount

taxpayer participates in the operation of the qualified business

invested or $50,000, whichever is less. The credit is not allowable

for the year in which the investment was made, but is allowable for

if the taxpayer, the taxpayer’s spouse, parent, brother or sister,

the taxable year beginning during the calendar year following the

child, or an employee of any of these individuals, or of a business

calendar year in which the investment was made.

controlled by any of these individuals, provides services of any

nature to the qualified business for compensation, whether as

Pass-Through Entities - A pass-through entity that purchases the

an employee, a contractor, or otherwise.

equity securities or subordinated debt of a qualified business is

(2) the registration of the qualified business is revoked because the

allowed a tax credit for the taxable year equal to 25% of the amount

qualified business provided false information to the Secretary

invested or $750,000, whichever is less. This credit is not allowed to

of State on its registration application.

a pass-through entity that has committed capital under management

(3) the taxpayer transfers the securities received in the investment

in excess of $5,000,000. Each individual who is an owner of a

to another person or entity within one year except in the case of

pass-through entity is allowed a credit equal to his allocated share

(a) the death of the taxpayer, (b) a final distribution in liquidation,

of the credits (not to exceed $50,000) for which the pass-through

or (c) a merger, conversion, consolidation, or other similar

entity is eligible. If the owner’s share of the pass-through entity’s

transaction in which no cash or tangible property is received.

credit is limited due to the maximum allowable credit for a taxable

(4) The organization in which the investment was made makes

year, the pass-through entity and its owners may not reallocate the

a redemption of the securities within five years. However, if a

unused credit among the other owners.

qualified business venture engaged primarily in motion picture

film production redeems its stock, the credit is not forfeited if

Investments made as an Individual and as an Individual Owner

of a Pass-through Entity - The aggregate amount of credit allowed

the following conditions are met:

(a) The redemption occurred because the qualified business

in a single tax year, for investments both as an individual and as

venture completed production of a film, sold the film, and

an individual who is an owner of a pass-through entity, is equal to

was liquidated.

25% of the amount invested or $50,000.00, whichever is less.

(b) Neither the qualified business venture nor a related person

B. Application -

To be eligible for the tax credit, you must

continues to engage in business with respect to the film

file this application with the Secretary of Revenue. The

produced by the business.

application should be filed on or before April 15 and no later

than October 15 of the year following the calendar year in which

If the tax credit is forfeited, the taxpayer is liable for all past taxes

the investment was made. An application filed after October

avoided as a result of the credit, plus interest computed from the date

15 will not be accepted. Do not attach this application to your

the taxes would have been due had the credit not been allowed. The

North Carolina income tax return. The application must be

past taxes and interest are due 30 days after the date the credit is

mailed separately to the address at the bottom on the front

forfeited. Any additional tax due as a result of forfeiture of the credit

of this form. The application for a qualified business investment

may be assessed within three years after the date of forfeiture.

by a pass-through entity must be filed by the pass-through entity.

H. Definitions -

If the investment was paid for other than in money, the taxpayer

Control - A person controls an entity if the person owns, directly or

must include with the application a certified appraisal of the value

indirectly more than ten percent (10%) of the voting securities of that

of the property used to pay for the investment.

entity.

C. Limit - The credit may not exceed the amount of tax liability for

Equity security - Common stock, preferred stock, or an interest in a

the taxable year reduced by the sum of all other credits allowable,

except tax payments. Any unused credit may be carried forward

partnership, or subordinated debt that is convertible into, or entitles the

for the next five succeeding years.

holder to receive upon its exercise, common stock, preferred stock, or

an interest in a partnership.

D. Ceiling - The total amount of all tax credits allowed for

qualified business investments in a calendar year may not exceed

Pass-through entity - An entity or business, including a limited

$7,500,000. The Secretary of Revenue will calculate the total

partnership, a general partnership, a joint venture, a Subchapter S

credits from the applications filed. If the total for the calendar year

Corporation, or a limited liability company, all of which is treated as owned

exceeds $7,500,000, a portion of the credits claimed will be allowed

by individuals or other entities under the federal tax laws, in which the

by allocating the $7,500,000 in proportion to the size of the credit

owners report their share of the income, losses, and credits from the

entity or business on their income tax returns filed with this State. An

claimed by each taxpayer. The Secretary of Revenue will notify

each taxpayer on or before December 31 of the year following the

owner of a pass-through entity is an individual or entity who is treated

calendar year in which the investment was made, if the credit applied

as an owner under the federal tax laws.

for is approved or if the amount of the credit has been reduced.

Qualified Business - A qualified business venture, a qualified grantee

E.

Reduction in Basis - A taxpayer’s basis in the equity securities

business, or a qualified licensee business.

or subordinated debt acquired as a result of an investment in a

Related person - A person described in one of the relationships in

qualified business must be reduced by the amount of allowable

section 267(b) or 707(b) of the Internal Revenue Code.

credit.

Subordinated debt - Indebtedness that (1) by its terms matures five or

F.

Registration - A qualified business must be registered with the

more years after its issuance, (2) is not secured, and (3) is subordinated

Securities Division of the Office of the Secretary of State. Information

to all other indebtedness of the issuer issued or to be issued to a

on the qualifying conditions under which they are registered can be

financial institution other than a financial institution described in G. S.

obtained from the Secretary of State. An investment made prior

105-163.010(5). Any portion of indebtedness that matures earlier than

to the effective date of the registration or after the revocation of the

five years after its issuance is not subordinated debt. However the

registration does not qualify for the tax credit. The effective date

requirement that indebtedness mature five or more years after it was

of registration of a qualified business venture whose application is

issued is not applicable to the subordinated debt of a qualified business

accepted for registration is 60 days before the date its application

venture that is engaged primarily in motion picture film production.

is filed. The effective date of registration for a qualified grantee

business or qualified licensee business whose application is

accepted for registration is the filing date of its application.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2