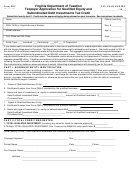

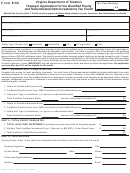

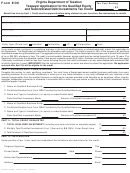

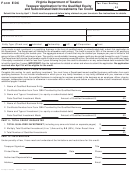

Form Edc - Virginia Taxpayer Application For Qualified Equity And Subordinated Debt Investments Tax Credit

ADVERTISEMENT

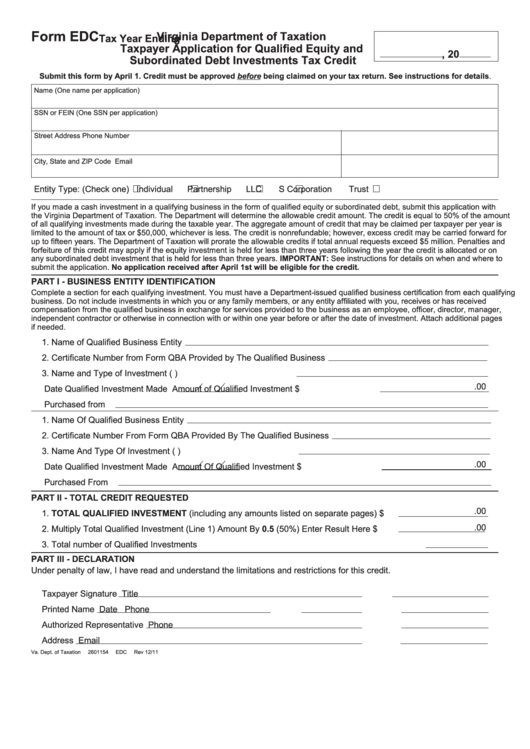

Form EDC

Virginia Department of Taxation

Tax Year Ending

Taxpayer Application for Qualified Equity and

, 20

Subordinated Debt Investments Tax Credit

Submit this form by April 1. Credit must be approved before being claimed on your tax return. See instructions for details.

Name (One name per application)

SSN or FEIN (One SSN per application)

Street Address

Phone Number

City, State and ZIP Code

Email

Entity Type: (Check one)

Individual

Partnership

LLC

S Corporation

Trust

If you made a cash investment in a qualifying business in the form of qualified equity or subordinated debt, submit this application with

the Virginia Department of Taxation. The Department will determine the allowable credit amount. The credit is equal to 50% of the amount

of all qualifying investments made during the taxable year. The aggregate amount of credit that may be claimed per taxpayer per year is

limited to the amount of tax or $50,000, whichever is less. The credit is nonrefundable; however, excess credit may be carried forward for

up to fifteen years. The Department of Taxation will prorate the allowable credits if total annual requests exceed $5 million. Penalties and

forfeiture of this credit may apply if the equity investment is held for less than three years following the year the credit is allocated or on

any subordinated debt investment that is held for less than three years. IMPORTANT: See instructions for details on when and where to

submit the application. No application received after April 1st will be eligible for the credit.

PART I - BUSINESS ENTITY IDENTIFICATION

Complete a section for each qualifying investment. You must have a Department-issued qualified business certification from each qualifying

business. Do not include investments in which you or any family members, or any entity affiliated with you, receives or has received

compensation from the qualified business in exchange for services provided to the business as an employee, officer, director, manager,

independent contractor or otherwise in connection with or within one year before or after the date of investment. Attach additional pages

if needed.

1. Name of Qualified Business Entity

2. Certificate Number from Form QBA Provided by The Qualified Business

3. Name and Type of Investment (i.e. equity or subordinated debt)

.00

Date Qualified Investment Made

Amount of Qualified Investment $

Purchased from

1. Name Of Qualified Business Entity

2. Certificate Number From Form QBA Provided By The Qualified Business

3. Name And Type Of Investment (i.e. equity or subordinated debt)

.00

Date Qualified Investment Made

Amount Of Qualified Investment $

Purchased From

PART II - TOTAL CREDIT REQUESTED

.00

1. TOTAL QUALIFIED INVESTMENT (including any amounts listed on separate pages)

$

.00

2. Multiply Total Qualified Investment (Line 1) Amount By 0.5 (50%) Enter Result Here

$

3. Total number of Qualified Investments

PART III - DECLARATION

Under penalty of law, I have read and understand the limitations and restrictions for this credit.

Taxpayer Signature

Title

Printed Name

Date

Phone

Authorized Representative

Phone

Address

Email

Va. Dept. of Taxation

2601154

EDC

Rev 12/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2