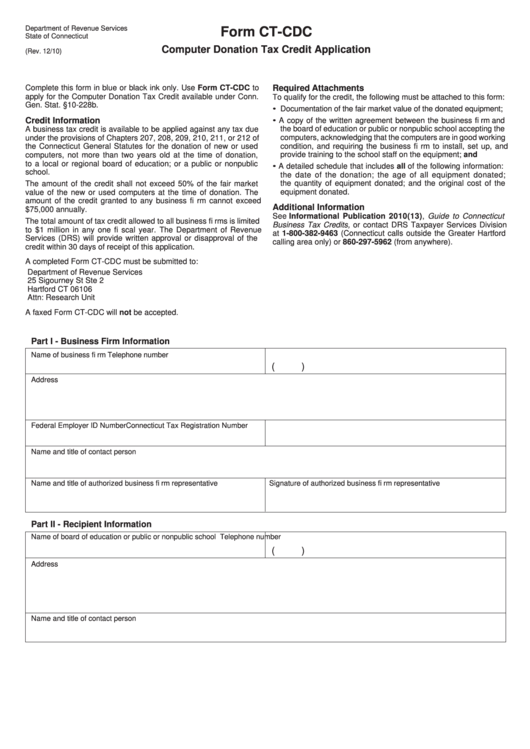

Form Ct-Cdc - Computer Donation Tax Credit Application

ADVERTISEMENT

Department of Revenue Services

Form CT-CDC

State of Connecticut

Computer Donation Tax Credit Application

(Rev. 12/10)

Complete this form in blue or black ink only. Use Form CT-CDC to

Required Attachments

apply for the Computer Donation Tax Credit available under Conn.

To qualify for the credit, the following must be attached to this form:

Gen. Stat. §10-228b.

• Documentation of the fair market value of the donated equipment;

Credit Information

• A copy of the written agreement between the business fi rm and

the board of education or public or nonpublic school accepting the

A business tax credit is available to be applied against any tax due

computers, acknowledging that the computers are in good working

under the provisions of Chapters 207, 208, 209, 210, 211, or 212 of

the Connecticut General Statutes for the donation of new or used

condition, and requiring the business fi rm to install, set up, and

provide training to the school staff on the equipment; and

computers, not more than two years old at the time of donation,

to a local or regional board of education; or a public or nonpublic

• A detailed schedule that includes all of the following information:

school.

the date of the donation; the age of all equipment donated;

the quantity of equipment donated; and the original cost of the

The amount of the credit shall not exceed 50% of the fair market

equipment donated.

value of the new or used computers at the time of donation. The

amount of the credit granted to any business fi rm cannot exceed

Additional Information

$75,000 annually.

See Informational Publication 2010(13), Guide to Connecticut

The total amount of tax credit allowed to all business fi rms is limited

Business Tax Credits, or contact DRS Taxpayer Services Division

to $1 million in any one fi scal year. The Department of Revenue

at 1-800-382-9463 (Connecticut calls outside the Greater Hartford

Services (DRS) will provide written approval or disapproval of the

calling area only) or 860-297-5962 (from anywhere).

credit within 30 days of receipt of this application.

A completed Form CT-CDC must be submitted to:

Department of Revenue Services

25 Sigourney St Ste 2

Hartford CT 06106

Attn: Research Unit

A faxed Form CT-CDC will not be accepted.

Part I - Business Firm Information

Name of business fi rm

Telephone number

(

)

Address

Federal Employer ID Number

Connecticut Tax Registration Number

Name and title of contact person

Name and title of authorized business fi rm representative

Signature of authorized business fi rm representative

Part II - Recipient Information

Name of board of education or public or nonpublic school

Telephone number

(

)

Address

Name and title of contact person

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2