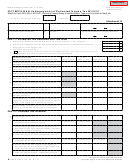

INSTRUCTIONS FOR SCHEDULE K-220

If any due date falls on a Saturday, Sunday, or legal holiday, substitute the next regular work day.

WHO MAY USE THIS SCHEDULE

c) for the first 6 months or for the first 8 months if

installment was required to be paid in the 9th month;

Schedule K-220 will help a corporation determine if it paid

and

the correct amount of estimated tax by the correct due date. If

d) for the first 9 months or first 11 months if installment

the minimum amount was not paid on time, an underpayment

was required to be paid in the 12th month.

penalty will be imposed for the period of underpayment.

PART II – FIGURING THE PENALTY

Every corporation is required to pay estimated tax for the

taxable year if its Kansas tax liability can reasonably be

LINE 8: Enter on line 8 the amount of underpayment of tax,

expected to exceed $500. A corporation is not required to file a

which is the lesser of one of the following computations:

declaration in its first year of existence in Kansas.

• Line 6 less line 5; or

Short Taxable Years. Any estimated tax, payable in

• Line 7 less line 5

installments, which is not paid before the 15th day of the last

month of a short taxable year shall be paid on the 15th day of

LINE 9: Enter the due date of each estimate payment

the last month of the short taxable year.

installment (15th day of the 4th, 6th, 9th and 12th months of

the tax year).

COMPLETING THIS SCHEDULE

IMPORTANT—You will need to compute the correct number of

Enter your name and your EIN (Employer Identification

days for each installment for lines 10 and 11 in order to compute

Number) in the space provided at the top of this schedule.

the applicable penalty rate for lines 12 and 13.

LINES 1 through 3: Complete these lines based on

information from your returns for this tax year and from the

LINE 10: Enter in the first column the number of days from

prior tax year.

the first installment due date to the next installment due date

and enter the same for the remaining installment due dates. Do

PART I – EXCEPTIONS TO THE PENALTY

not compute the number of days for this line past 12/31/13.

You will NOT be subject to a penalty if your 2013 tax

Days past that date are to be entered on line 11.

payments (line 5, columns 1 through 4) equal or exceed the

EXAMPLE: For the fiscal year ending 6/30/14 the installment

amounts for one of the exceptions (lines 6 or 7, columns 1

due dates are 10/15/13, 12/15/13, 3/15/14 and 6/15/14;

through 4) for the same payment period.

therefore, the taxpayer will enter on line 10 the following

number of days: Column 1 - 10/15/13 to 12/15/13 equals

LINE 4: Enter the due date of each estimate payment

61 days. Column 2 - 12/15/13 to 12/31/13 equals 16 days.

installment (15th day of the 4th, 6th, 9th and 12th months for

Columns 3 and 4 of this line will not be completed since the

the tax year).

number of days has been computed to 12/31/13. The

computation for this fiscal year will continue on line 11.

LINE 5: Enter the cumulative amount of timely paid

estimated tax payment made in each quarter.

LINE 11: Enter the number of days from 1/1/14 to the due

EXAMPLE: For a calendar year, column 3 will be the total of

date of the next installment (if one exists). From the last

your timely paid estimated payments made from January 1

installment date enter the number of days to the date paid or

through September 15, 2013.

the due date of the return, whichever is earlier. The following

example continues the computation example from line 10.

LINE 6: Exception 1. This exception applies if the amount

on line 5 of a column equals or exceeds the amount on line 6

EXAMPLE: Column 1 - blank since there are no days prior to

for the same column. Enter the amount from line 2 or line 3

1/1/13 on this line. Column 2 - 1/1/14 to 3/15/14 equals 74

(whichever is less) times the percentages shown in each

days. (Note: The 16 days previously entered on line 10 plus

column of the schedule.

the 74 days equals the total number of days from 12/15/13 to

3/15/14.) Column 3 - 3/15/14 to 6/15/14 equals 92 days.

LINE 7: Exception 2. This exception applies if the amount

Column 4 - to be computed from 6/15/14 to the date the tax

on line 5 of a column equals or exceeds the amount on line 7

was paid or 10/15/14 (due date of the return), whichever is

for the same column, if applicable. A corporation may annualize

earlier.

its income if the corporation made an estimated tax payment

LINES 12 and 13: Penalty is computed at 4% for both the

of at least 90% of the amount it would owe if its estimated tax

2013 and 2014 periods.

were a tax computed on annualized taxable income for the

months preceding an installment date. The computation is as

LINE 14: For each column, add lines 12 and 13 and enter

follows:

the result.

LINE 15: Add amounts in each column of line 14 and enter

a) for the first 3 months, if the installment was required

to be paid in the 4th month;

the total on line 15 and on the Estimated Tax Penalty line of

b) for the first 3 months or first 5 months, if installment

Form K-120. If you are annualizing to meet an exception (line

was required to be paid in the 6th month;

7, K-220) check the box within the Estimated Tax Penalty line.

1

1 2

2