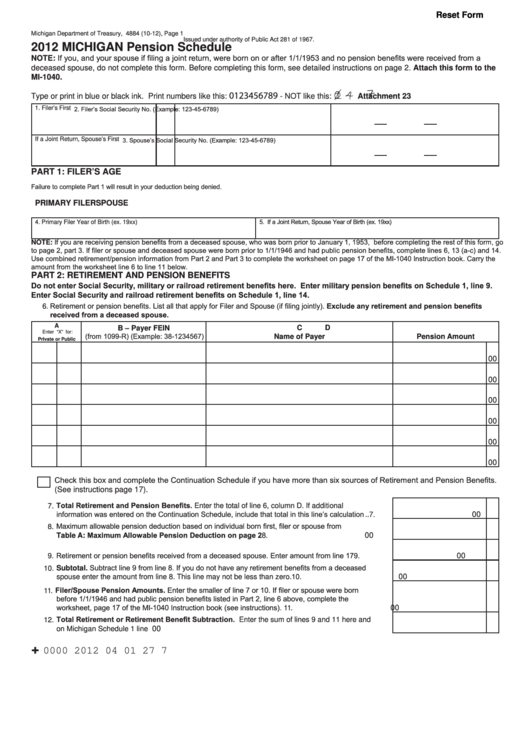

Reset Form

Michigan Department of Treasury, 4884 (10-12), Page 1

Issued under authority of Public Act 281 of 1967.

2012 MICHIGAN Pension Schedule

NOTE: If you, and your spouse if filing a joint return, were born on or after 1/1/1953 and no pension benefits were received from a

deceased spouse, do not complete this form. Before completing this form, see detailed instructions on page 2. Attach this form to the

MI-1040.

1 4

0123456789

Type or print in blue or black ink. Print numbers like this:

- NOT like this:

Attachment 23

2. Filer’s Social Security No. (Example: 123-45-6789)

1. Filer’s First Name

M.I.

Last Name

3. Spouse’s Social Security No. (Example: 123-45-6789)

If a Joint Return, Spouse’s First Name

M.I.

Last Name

PART 1: FILER’S AGE

Failure to complete Part 1 will result in your deduction being denied.

PRIMARY FILER

SPOUSE

5. If a Joint Return, Spouse Year of Birth (ex. 19xx)

4. Primary Filer Year of Birth (ex. 19xx)

NOTE: If you are receiving pension benefits from a deceased spouse, who was born prior to January 1, 1953, before completing the rest of this form, go

to page 2, part 3. If filer or spouse and deceased spouse were born prior to 1/1/1946 and had public pension benefits, complete lines 6, 13 (a-c) and 14.

Use combined retirement/pension information from Part 2 and Part 3 to complete the worksheet on page 17 of the MI-1040 Instruction book. Carry the

amount from the worksheet line 6 to line 11 below.

PART 2: RETIREMENT AND PENSION BENEFITS

Do not enter Social Security, military or railroad retirement benefits here. Enter military pension benefits on Schedule 1, line 9.

Enter Social Security and railroad retirement benefits on Schedule 1, line 14.

6. Retirement or pension benefits. List all that apply for Filer and Spouse (if filing jointly). Exclude any retirement and pension benefits

received from a deceased spouse.

A

B – Payer FEIN

C

D

Enter “X” for:

(from 1099-R) (Example: 38-1234567)

Name of Payer

Pension Amount

Private or Public

00

00

00

00

00

00

Check this box and complete the Continuation Schedule if you have more than six sources of Retirement and Pension Benefits.

(See instructions page 17).

7. Total Retirement and Pension Benefits. Enter the total of line 6, column D. If additional

information was entered on the Continuation Schedule, include that total in this line’s calculation ..

7.

00

8. Maximum allowable pension deduction based on individual born first, filer or spouse from

Table A: Maximum Allowable Pension Deduction on page 2 ....................................................

00

8.

9. Retirement or pension benefits received from a deceased spouse. Enter amount from line 17 .....

00

9.

10. Subtotal. Subtract line 9 from line 8. If you do not have any retirement benefits from a deceased

spouse enter the amount from line 8. This line may not be less than zero. ...................................... 10.

00

11. Filer/Spouse Pension Amounts. Enter the smaller of line 7 or 10. If filer or spouse were born

before 1/1/1946 and had public pension benefits listed in Part 2, line 6 above, complete the

worksheet, page 17 of the MI-1040 Instruction book (see instructions).

00

11.

12. Total Retirement or Retirement Benefit Subtraction. Enter the sum of lines 9 and 11 here and

on Michigan Schedule 1 line 12......................................................................................................... 12.

00

+

0000 2012 04 01 27 7

1

1 2

2