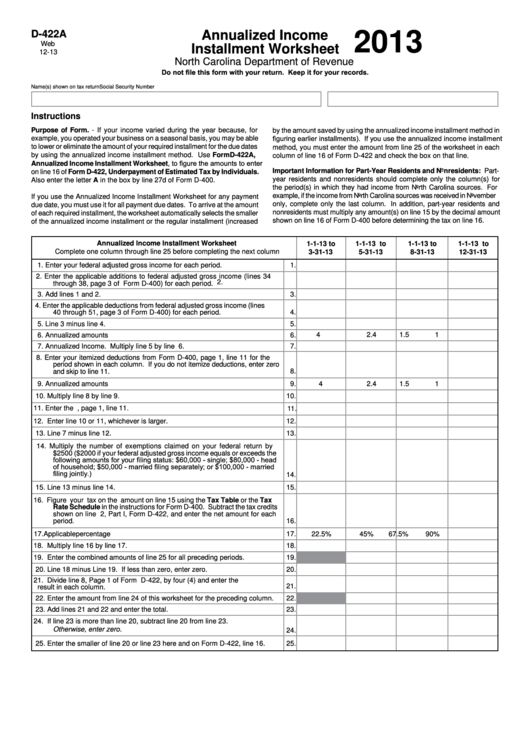

D-422A

Annualized Income

2013

Web

Installment Worksheet

12-13

North Carolina Department of Revenue

Do not file this form with your return. Keep it for your records.

Name(s) shown on tax return

Social Security Number

Instructions

Purpose of Form. - If your income varied during the year because, for

by the amount saved by using the annualized income installment method in

figuring earlier installments). If you use the annualized income installment

example, you operated your business on a seasonal basis, you may be able

to lower or eliminate the amount of your required installment for the due dates

method, you must enter the amount from line 25 of the worksheet in each

by using the annualized income installment method. Use Form D-422A,

column of line 16 of Form D-422 and check the box on that line.

Annualized Income Installment Worksheet, to figure the amounts to enter

Important Information for Part-Year Residents and Nonresidents: Part-

on line 16 of Form D-422, Underpayment of Estimated Tax by Individuals.

year residents and nonresidents should complete only the column(s) for

Also enter the letter A in the box by line 27d of Form D-400.

the period(s) in which they had income from North Carolina sources. For

example, if the income from North Carolina sources was received in November

If you use the Annualized Income Installment Worksheet for any payment

only, complete only the last column. In addition, part-year residents and

due date, you must use it for all payment due dates. To arrive at the amount

nonresidents must multiply any amount(s) on line 15 by the decimal amount

of each required installment, the worksheet automatically selects the smaller

shown on line 16 of Form D-400 before determining the tax on line 16.

of the annualized income installment or the regular installment (increased

Annualized Income Installment Worksheet

1-1-13 to

1-1-13 to

1-1-13 to

1-1-13 to

Complete one column through line 25 before completing the next column

3-31-13

5-31-13

8-31-13

12-31-13

1.

Enter your federal adjusted gross income for each period.

1.

2.

Enter the applicable additions to federal adjusted gross income (lines 34

2.

through 38, page 3 of Form D-400) for each period.

3.

Add lines 1 and 2.

3.

4.

Enter the applicable deductions from federal adjusted gross income (lines

40 through 51, page 3 of Form D-400) for each period.

4.

5.

Line 3 minus line 4.

5.

4

2.4

1.5

1

6.

Annualized amounts

6.

7.

Annualized Income. Multiply line 5 by line 6.

7.

8.

Enter your itemized deductions from Form D-400, page 1, line 11 for the

period shown in each column. If you do not itemize deductions, enter zero

and skip to line 11.

8.

9.

Annualized amounts

9.

4

2.4

1.5

1

10.

Multiply line 8 by line 9.

10.

11.

Enter the N.C. standard deduction from Form D-400, page 1, line 11.

11.

12.

Enter line 10 or 11, whichever is larger.

12.

13.

Line 7 minus line 12.

13.

14.

Multiply the number of exemptions claimed on your federal return by

$2500 ($2000 if your federal adjusted gross income equals or exceeds the

following amounts for your filing status: $60,000 - single; $80,000 - head

of household; $50,000 - married filing separately; or $100,000 - married

filing jointly.)

14.

15.

Line 13 minus line 14.

15.

16.

Figure your tax on the amount on line 15 using the Tax Table or the Tax

Rate Schedule in the instructions for Form D-400. Subtract the tax credits

shown on line 2, Part I, Form D-422, and enter the net amount for each

period.

16.

17.

Applicable percentage

17.

22.5%

45%

67.5%

90%

18.

Multiply line 16 by line 17.

18.

19.

Enter the combined amounts of line 25 for all preceding periods.

19.

20.

Line 18 minus Line 19. If less than zero, enter zero.

20.

21.

Divide line 8, Page 1 of Form D-422, by four (4) and enter the

21.

result in each column.

22.

Enter the amount from line 24 of this worksheet for the preceding column.

22.

23.

Add lines 21 and 22 and enter the total.

23.

24.

If line 23 is more than line 20, subtract line 20 from line 23.

Otherwise, enter zero.

24.

25.

Enter the smaller of line 20 or line 23 here and on Form D-422, line 16.

25.

1

1