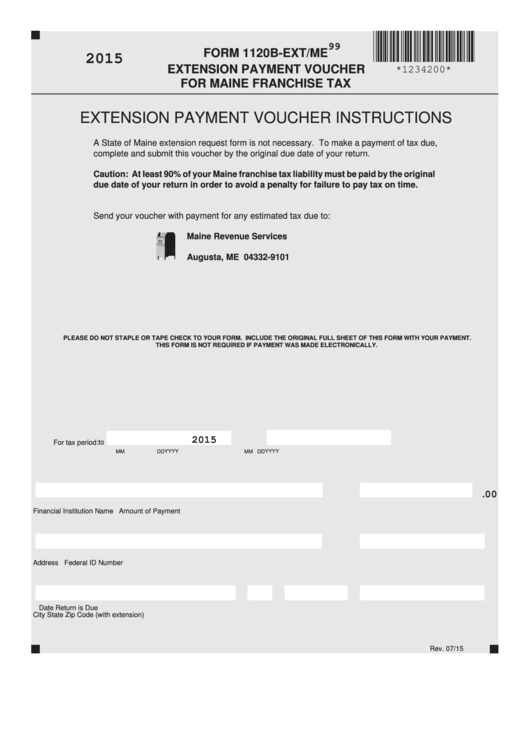

Form 1120b-Ext/me - Extension Payment Voucher For Maine Franchise Tax - 2015

ADVERTISEMENT

99

FORM 1120B-EXT/ME

2015

EXTENSION PAYMENT VOUCHER

*1234200*

FOR MAINE FRANCHISE TAX

EXTENSION PAYMENT VOUCHER INSTRUCTIONS

A State of Maine extension request form is not necessary. To make a payment of tax due,

complete and submit this voucher by the original due date of your return.

Caution: At least 90% of your Maine franchise tax liability must be paid by the original

due date of your return in order to avoid a penalty for failure to pay tax on time.

Send your voucher with payment for any estimated tax due to:

Maine Revenue Services

P.O. Box 9101

Augusta, ME 04332-9101

PLEASE DO NOT STAPLE OR TAPE CHECK TO YOUR FORM. INCLUDE THE ORIGINAL FULL SHEET OF THIS FORM WITH YOUR PAYMENT.

THIS FORM IS NOT REQUIRED IF PAYMENT WAS MADE ELECTRONICALLY.

2015

to

For tax period:

YYYY

YYYY

MM

DD

MM

DD

.

00

Financial Institution Name

Amount of Payment

Address

Federal ID Number

Date Return is Due

City

State

Zip Code

(with extension)

Rev. 07/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1