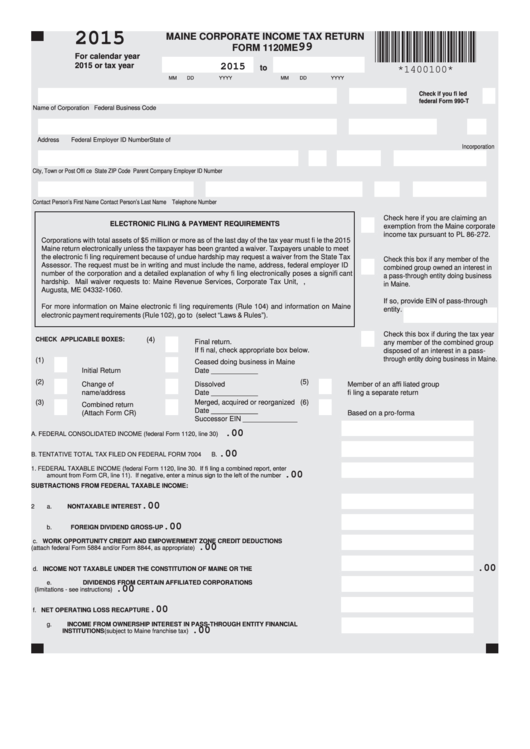

Form 1120me - Maine Corporate Income Tax Return - 2015

ADVERTISEMENT

2015

MAINE CORPORATE INCOME TAX RETURN

99

FORM 1120ME

For calendar year

2015 or tax year

2015

to

*1400100*

MM

DD

YYYY

MM

DD

YYYY

Check if you fi led

federal Form 990-T

Name of Corporation

Federal Business Code

Address

Federal Employer ID Number

State of

Incorporation

City, Town or Post Offi ce

State

ZIP Code

Parent Company Employer ID Number

Contact Person’s First Name

Contact Person’s Last Name

Telephone Number

Check here if you are claiming an

ELECTRONIC FILING & PAYMENT REQUIREMENTS

exemption from the Maine corporate

income tax pursuant to PL 86-272.

Corporations with total assets of $5 million or more as of the last day of the tax year must fi le the 2015

Maine return electronically unless the taxpayer has been granted a waiver. Taxpayers unable to meet

the electronic fi ling requirement because of undue hardship may request a waiver from the State Tax

Check this box if any member of the

Assessor. The request must be in writing and must include the name, address, federal employer ID

combined group owned an interest in

number of the corporation and a detailed explanation of why fi ling electronically poses a signifi cant

a pass-through entity doing business

hardship. Mail waiver requests to: Maine Revenue Services, Corporate Tax Unit, P.O. Box 1060,

in Maine.

Augusta, ME 04332-1060.

If so, provide EIN of pass-through

For more information on Maine electronic fi ling requirements (Rule 104) and information on Maine

entity.

electronic payment requirements (Rule 102), go to (select “Laws & Rules”).

Check this box if during the tax year

CHECK APPLICABLE BOXES:

(4)

Final return.

any member of the combined group

If fi nal, check appropriate box below.

disposed of an interest in a pass-

through entity doing business in Maine.

(1)

Ceased doing business in Maine

Initial Return

Date ____________

(2)

(5)

Change of

Dissolved

Member of an affi liated group

name/address

Date ____________

fi ling a separate return

(3)

Merged, acquired or reorganized

(6)

Combined return

Date ____________

(Attach Form CR)

Based on a pro-forma

Successor EIN ______________

.00

A.

FEDERAL CONSOLIDATED INCOME (federal Form 1120, line 30) .................................................. A.

.00

B.

TENTATIVE TOTAL TAX FILED ON FEDERAL FORM 7004 ............................................................... B.

1.

FEDERAL TAXABLE INCOME (federal Form 1120, line 30. If fi ling a combined report, enter

.00

amount from Form CR, line 11). If negative, enter a minus sign to the left of the number ...................

1.

SUBTRACTIONS FROM FEDERAL TAXABLE INCOME:

.00

2

a. NONTAXABLE INTEREST ............................................................................................................. 2a.

.00

b. FOREIGN DIVIDEND GROSS-UP.................................................................................................. 2b.

c. WORK OPPORTUNITY CREDIT AND EMPOWERMENT ZONE CREDIT DEDUCTIONS

.00

(attach federal Form 5884 and/or Form 8844, as appropriate) ......................................................... 2c.

.00

d. INCOME NOT TAXABLE UNDER THE CONSTITUTION OF MAINE OR THE U.S. ........................ 2d.

e. DIVIDENDS FROM CERTAIN AFFILIATED CORPORATIONS

.00

(limitations - see instructions) ........................................................................................................... 2e.

.00

f. NET OPERATING LOSS RECAPTURE .......................................................................................... 2f.

g. INCOME FROM OWNERSHIP INTEREST IN PASS-THROUGH ENTITY FINANCIAL

.00

INSTITUTIONS (subject to Maine franchise tax) ............................................................................. 2g.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6