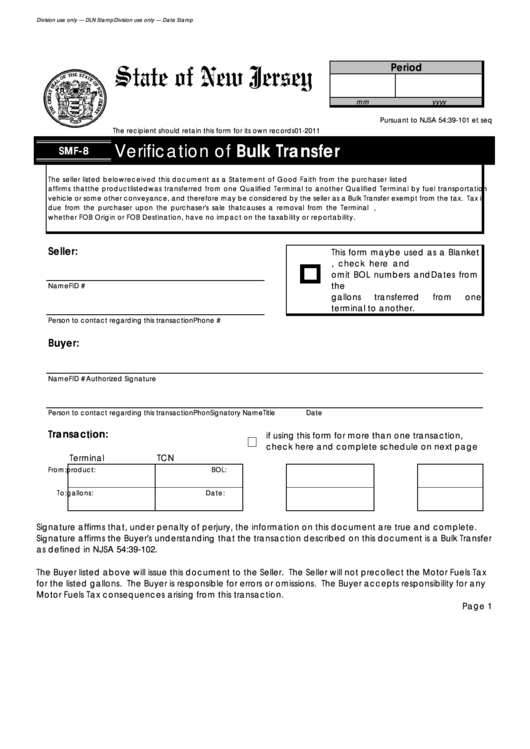

Division use only — DLN Stamp

Division use only — Date Stamp

Period

mm

yyyy

Pursuant to NJSA 54:39-101 et seq

The recipient should retain this form for its own records

01-2011

Verification of Bulk Transfer

SMF-8

The seller listed below received this document as a Statement of Good Faith from the purchaser listed below. This document

affirms that the product listed was transferred from one Qualified Terminal to another Qualified Terminal by fuel transportation

vehicle or some other conveyance, and therefore may be considered by the seller as a Bulk Transfer exempt from the tax. Tax is

due from the purchaser upon the purchaser's sale that causes a removal from the Terminal System. The terms of the sale,

whether FOB Origin or FOB Destination, have no impact on the taxability or reportability.

Seller:

This form may be used as a Blanket

form. If so used, check here and

omit BOL numbers and Dates from

the schedules. State only the total

Name

FID #

gallons

transferred

from

one

terminal to another.

Person to contact regarding this transaction Phone #

Buyer:

Name

FID #

Authorized Signature

Person to contact regarding this transaction Phon

Signatory Name

Title

Date

Transaction:

if using this form for more than one transaction,

check here and complete schedule on next page

Terminal

TCN

From:

product:

BOL:

To:

gallons:

Date:

Signature affirms that, under penalty of perjury, the information on this document are true and complete.

Signature affirms the Buyer's understanding that the transaction described on this document is a Bulk Transfer

as defined in NJSA 54:39-102.

The Buyer listed above will issue this document to the Seller. The Seller will not precollect the Motor Fuels Tax

for the listed gallons. The Buyer is responsible for errors or omissions. The Buyer accepts responsibility for any

Motor Fuels Tax consequences arising from this transaction.

Page 1

1

1 2

2