Print

Reset

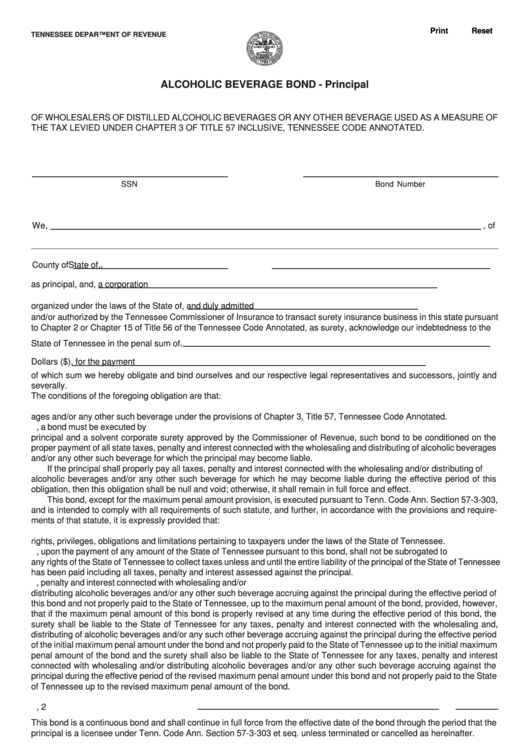

TENNESSEE DEPARTMENT OF REVENUE

ALCOHOLIC BEVERAGE BOND - Principal

OF WHOLESALERS OF DISTILLED ALCOHOLIC BEVERAGES OR ANY OTHER BEVERAGE USED AS A MEASURE OF

THE TAX LEVIED UNDER CHAPTER 3 OF TITLE 57 INCLUSIVE, TENNESSEE CODE ANNOTATED.

SSN

Bond Number

We,

, of

,

County of

State of,

, a corporation

as principal, and

organized under the laws of the State of

, and duly admitted

and/or authorized by the Tennessee Commissioner of Insurance to transact surety insurance business in this state pursuant

to Chapter 2 or Chapter 15 of Title 56 of the Tennessee Code Annotated, as surety, acknowledge our indebtedness to the

,

State of Tennessee in the penal sum of

Dollars ($

), for the payment

of which sum we hereby obligate and bind ourselves and our respective legal representatives and successors, jointly and

severally.

The conditions of the foregoing obligation are that:

1. Principal has applied to the State of Tennessee for Certificate of Registration to wholesale or distribute alcoholic bever-

ages and/or any other such beverage under the provisions of Chapter 3, Title 57, Tennessee Code Annotated.

2. Pursuant to Tenn. Code Ann. Section 57-3-303 and the rules promulgated pursuant thereto, a bond must be executed by

principal and a solvent corporate surety approved by the Commissioner of Revenue, such bond to be conditioned on the

proper payment of all state taxes, penalty and interest connected with the wholesaling and distributing of alcoholic beverages

and/or any other such beverage for which the principal may become liable.

If the principal shall properly pay all taxes, penalty and interest connected with the wholesaling and/or distributing of

alcoholic beverages and/or any other such beverage for which he may become liable during the effective period of this

obligation, then this obligation shall be null and void; otherwise, it shall remain in full force and effect.

This bond, except for the maximum penal amount provision, is executed pursuant to Tenn. Code Ann. Section 57-3-303,

and is intended to comply with all requirements of such statute, and further, in accordance with the provisions and require-

ments of that statute, it is expressly provided that:

1. Both the principal and surety under this bond shall be considered the taxpayers as to the State of Tennessee with all

rights, privileges, obligations and limitations pertaining to taxpayers under the laws of the State of Tennessee.

2. The surety, upon the payment of any amount of the State of Tennessee pursuant to this bond, shall not be subrogated to

any rights of the State of Tennessee to collect taxes unless and until the entire liability of the principal of the State of Tennessee

has been paid including all taxes, penalty and interest assessed against the principal.

3. The surety shall be liable to the State of Tennessee for any taxes, penalty and interest connected with wholesaling and/or

distributing alcoholic beverages and/or any other such beverage accruing against the principal during the effective period of

this bond and not properly paid to the State of Tennessee, up to the maximum penal amount of the bond, provided, however,

that if the maximum penal amount of this bond is properly revised at any time during the effective period of this bond, the

surety shall be liable to the State of Tennessee for any taxes, penalty and interest connected with the wholesaling and,

distributing of alcoholic beverages and/or any such other beverage accruing against the principal during the effective period

of the initial maximum penal amount under the bond and not properly paid to the State of Tennessee up to the initial maximum

penal amount of the bond and the surety shall also be liable to the State of Tennessee for any taxes, penalty and interest

connected with wholesaling and/or distributing alcoholic beverages and/or any other such beverage accruing against the

principal during the effective period of the revised maximum penal amount under this bond and not properly paid to the State

of Tennessee up to the revised maximum penal amount of the bond.

4. The effective date of this bond shall be

, 2

This bond is a continuous bond and shall continue in full force from the effective date of the bond through the period that the

principal is a licensee under Tenn. Code Ann. Section 57-3-303 et seq. unless terminated or cancelled as hereinafter.

5. Surety may cancel this bond and be relieved of further liability hereon by giving sixty (60) days written notice to the

Tennessee Department of Revenue, Taxpayer Services Division, Andrew Jackson State Office Building, Nashville, Tennessee

37242, but such cancellation shall not affect any liability incurred or accrued hereunder prior to the termination of the notice

period.

6. It is specifically understood and agreed that the principal and surety under this bond are liable pursuant to the provisions

of this bond, including, but not limited to the maximum penal amount set forth herein, notwithstanding any provisions of Tenn.

Code Ann. Section 57-3-303, regarding maximum penal amounts, to the contrary.

RV-F1320801 (Rev. 2-13)

INTERNET (2-13)

1

1 2

2