Form Ct-1120 Hcic - Connecticut Human Capital Investment Tax Credit - 2014

ADVERTISEMENT

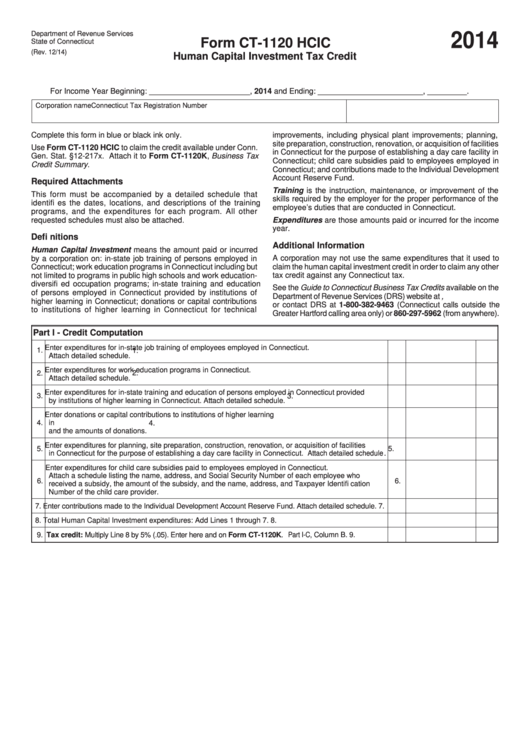

Department of Revenue Services

2014

Form CT-1120 HCIC

State of Connecticut

(Rev. 12/14)

Human Capital Investment Tax Credit

For Income Year Beginning: _______________________ , 2014 and Ending: ________________________ , _________ .

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only.

improvements, including physical plant improvements; planning,

site preparation, construction, renovation, or acquisition of facilities

Use Form CT-1120 HCIC to claim the credit available under Conn.

in Connecticut for the purpose of establishing a day care facility in

Gen. Stat. §12-217x. Attach it to Form CT-1120K, Business Tax

Connecticut; child care subsidies paid to employees employed in

Credit Summary.

Connecticut; and contributions made to the Individual Development

Account Reserve Fund.

Required Attachments

Training is the instruction, maintenance, or improvement of the

This form must be accompanied by a detailed schedule that

skills required by the employer for the proper performance of the

identifi es the dates, locations, and descriptions of the training

employee’s duties that are conducted in Connecticut.

programs, and the expenditures for each program. All other

Expenditures are those amounts paid or incurred for the income

requested schedules must also be attached.

year.

Defi nitions

Additional Information

Human Capital Investment means the amount paid or incurred

by a corporation on: in-state job training of persons employed in

A corporation may not use the same expenditures that it used to

Connecticut; work education programs in Connecticut including but

claim the human capital investment credit in order to claim any other

not limited to programs in public high schools and work education-

tax credit against any Connecticut tax.

diversifi ed occupation programs; in-state training and education

See the Guide to Connecticut Business Tax Credits available on the

of persons employed in Connecticut provided by institutions of

Department of Revenue Services (DRS) website at ,

higher learning in Connecticut; donations or capital contributions

or contact DRS at 1-800-382-9463 (Connecticut calls outside the

to institutions of higher learning in Connecticut for technical

Greater Hartford calling area only) or 860-297-5962 (from anywhere).

Part I - Credit Computation

1. Enter expenditures for in-state job training of employees employed in Connecticut.

1.

Attach detailed schedule.

2. Enter expenditures for work education programs in Connecticut.

2.

Attach detailed schedule.

3. Enter expenditures for in-state training and education of persons employed in Connecticut provided

3.

by institutions of higher learning in Connecticut. Attach detailed schedule.

Enter donations or capital contributions to institutions of higher learning

4.

in Connecticut. Attach a schedule listing the names of the institutions

4.

and the amounts of donations.

5. Enter expenditures for planning, site preparation, construction, renovation, or acquisition of facilities

5.

in Connecticut for the purpose of establishing a day care facility in Connecticut. Attach detailed schedule.

Enter expenditures for child care subsidies paid to employees employed in Connecticut.

Attach a schedule listing the name, address, and Social Security Number of each employee who

6.

6.

received a subsidy, the amount of the subsidy, and the name, address, and Taxpayer Identifi cation

Number of the child care provider.

7. Enter contributions made to the Individual Development Account Reserve Fund. Attach detailed schedule.

7.

8. Total Human Capital Investment expenditures: Add Lines 1 through 7.

8.

9. Tax credit: Multiply Line 8 by 5% (.05). Enter here and on Form CT-1120K. Part I-C, Column B.

9.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2