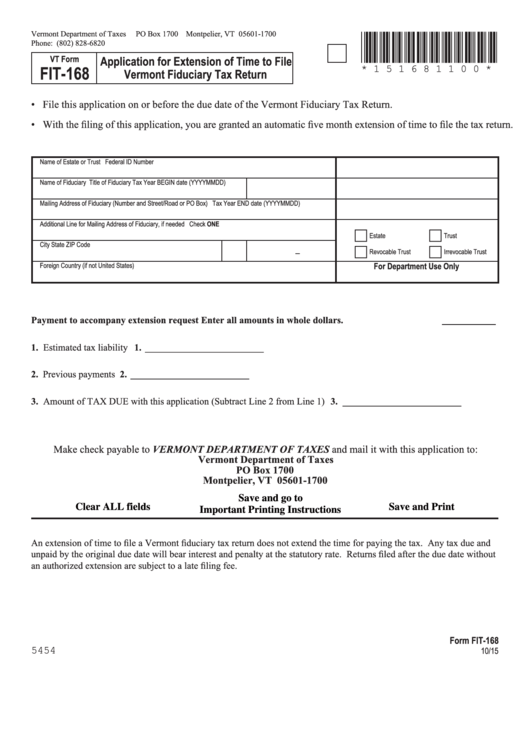

Vermont Department of Taxes

PO Box 1700 Montpelier, VT 05601-1700

*151681100*

Phone: (802) 828-6820

Application for Extension of Time to File

VT Form

FIT-168

* 1 5 1 6 8 1 1 0 0 *

Vermont Fiduciary Tax Return

• File this application on or before the due date of the Vermont Fiduciary Tax Return.

• With the filing of this application, you are granted an automatic five month extension of time to file the tax return.

Name of Estate or Trust

Federal ID Number

Name of Fiduciary

Title of Fiduciary

Tax Year BEGIN date (YYYYMMDD)

Mailing Address of Fiduciary (Number and Street/Road or PO Box)

Tax Year END date (YYYYMMDD)

Additional Line for Mailing Address of Fiduciary, if needed

Check ONE

c

c

Estate

Trust

City

State

ZIP Code

c

c

-

Revocable Trust

Irrevocable Trust

For Department Use Only

Foreign Country (if not United States)

Payment to accompany extension request

Enter all amounts in whole dollars.

1. Estimated tax liability . . . . . . . . . . . . . . . . . 1. _________________________

2. Previous payments . . . . . . . . . . . . . . . . . . . . 2. _________________________

3. Amount of TAX DUE with this application (Subtract Line 2 from Line 1) . . . . . . . . .3. _________________________

Make check payable to VERMONT DEPARTMENT OF TAXES and mail it with this application to:

Vermont Department of Taxes

PO Box 1700

Montpelier, VT 05601-1700

Save and go to

Clear ALL fields

Save and Print

Important Printing Instructions

An extension of time to file a Vermont fiduciary tax return does not extend the time for paying the tax. Any tax due and

unpaid by the original due date will bear interest and penalty at the statutory rate. Returns filed after the due date without

an authorized extension are subject to a late filing fee.

Form FIT-168

5454

10/15

1

1