Form Amft-71 - Arkansas Ifta Application

ADVERTISEMENT

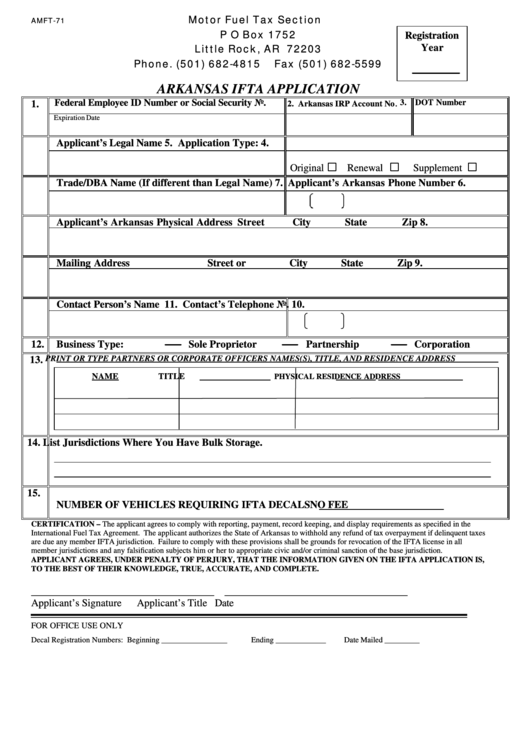

Motor Fuel Tax Section

AMFT-71

P O Box 1752

Registration

Little Rock, AR 72203

Year

Phone. (501) 682-4815

Fax (501) 682-5599

ARKANSAS IFTA APPLICATION

Federal Employee ID Number or Social Security No.

1.

.

3. U.S. DOT Number

2. Arkansas IRP Account No

Expiration Date

4.

Applicant’s Legal Name

5. Application Type:

Original

Renewal

Supplement

6.

Trade/DBA Name (If different than Le gal Name)

7. Applicant’s Arkansas Phone Number

8.

Applicant’s Arkansas Physical Address

Street

City

State

Zip

9.

Mailing Address

Street or P.O. Box

City

State

Zip

10.

Contact Person’s Name

11. Contact’s Telephone No.

12.

Business Type:

Sole Proprietor

Partnership

Corporation

PRINT OR TYPE PARTNERS OR CORPORATE OFFICERS NAMES(S), TITLE, AND RESIDENCE ADDRESS

13.

NAME

TITLE

PHYSICAL RESIDENCE ADDRESS

14.

List Jurisdictions Where You Have Bulk Storage.

15.

NUMBER OF VEHICLES REQUIRING IFTA DECALS

NO FEE

CERTIFICATION – The applicant agrees to comply with reporting, payment, record keeping, and display requirements as specified in the

International Fuel Tax Agreement. The applicant authorizes the State of Arkansas to withhold any refund of tax overpayment if delinquent taxes

are due any member IFTA jurisdiction. Failure to comply with these provisions shall be grounds for revocation of the IFTA license in all

member jurisdictions and any falsification subjects him or her to appropriate civic and/or criminal sanction of the base jurisdiction.

APPLICANT AGREES, UNDER PENALTY OF PERJURY, THAT THE INFORMATION GIVEN ON THE IFTA APPLICATION IS,

TO THE BEST OF THEIR KNOWLEDGE, TRUE, ACCURATE, AND COMPLETE.

___________________________________

___________________________________

Applicant’s Signature

Applicant’s Title

Date

FOR OFFICE USE ONLY

Decal Registration Numbers:

Beginning _________________

Ending _____________

Date Mailed _________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1