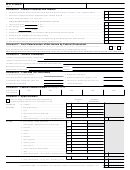

RI-1120C

Name

Federal employer identification number

page 3

Schedule E - Exempt Dividends and Interest

1.

1. Dividends received from shares of stock of any payer liable for RI taxes as outlined in Chapters 11, 13, & 14 (attach schedule) ...................

2.

2. Amount of such dividends included in Special Deductions, Schedule B, line 2B ................................................................................................

3.

3. Balance of Exempt Dividends. Line 1 less line 2 ................................................................................................................................................

Foreign Dividends included on line 13, 14 & 17 Schedule C, US 1120

4.

4. Less than 20% owned

X 70% ..............................................................................................................................................

5.

5. More than 20% owned

X 80%..............................................................................................................................................

6.

6. 100% owned

X 100% ...........................................................................................................................................................

7.

7. Interest on obligations of public service corporations liable for Rhode Island Gross Earnings Tax ....................................................................

8.

8. Interest on certain obligations of the US (attach schedule) .................................................................................................................................

9.

9. Interest on obligations of US possessions and other interest exempt under Rhode Island Law (attach schedule)............................................

10. Total. Add lines 3 through 9. Enter here and on page 2, Schedule B, line 2C ..................................................................................................

10.

Schedule F - Final Determination of Net Income by Federal Government

Yes

No

Has the Federal Government changed your taxable income for any prior year which has not yet been reported to The Tax Administrator?...................

If yes, complete Form RI-1120X immediately and submit to the Tax Administrator with any remittance that may be due.

NOTE: Changes made by the Federal Government in the income of any prior year must be reported to the Tax Administrator within 60 days after a final determination.

Schedule G - General Information

Location of principal place of business in Rhode Island

Location of corporation’s books and records

List states to which you are liable for income or excise taxes for the taxable year

US Business Code Number

President

State and date of incorporation

Treasurer

Schedule H - Franchise Tax Calculation

1. Number of Shares of Authorized Stock

5. Multiply line 4 times $2.50

2. Par Value per Share of Stock (No par value = $100)

6. Apportionment Ratio from Schedule J, line 5

3. Authorized Capital. Multiply line 1 times line 2

7. Franchise Tax. Multiply line 5 times line 6, but

4. Divide line 3 by $10,000.00

not less than $500.00

Schedule I - Federal Taxable Income

(US 1120, page 1, line 28)

2013

2012

2011

2010

2009

Enter amount for

year that ended:

Schedule J - Apportionment

Check if utilizing an alternative allocation apportionment

COLUMN A

COLUMN B

calculation allowed under 44-11-14.1 through 44-11-14.6.

RI

EVERYWHERE

1a.

Average net

1. a. Inventory ....................................................................................

1b.

book value

b. Depreciable assets ....................................................................

1c.

c. Land...........................................................................................

1d.

d. Rent (8 times annual net rental rate).........................................

1e.

e. Total ...........................................................................................

1f.

_._ _ _ _ _ _

f. Ratio in Rhode Island. Line 1e, column A divided by line 1e, column B...........................................................................

Receipts

2. a. Gross receipts - Rhode Island Sales.........................................

2a.

Gross receipts - Sales Under 44-11-14 (a) (2) (i) (B)...............

2b.

b. Dividends ...................................................................................

2c.

c. Interest........................................................................................

2d.

d. Rents ..........................................................................................

2e.

e. Royalties .....................................................................................

2f.

f. Net capital gains .........................................................................

2g.

g. Ordinary income .........................................................................

2h.

h. Other income ..............................................................................

2i.

i. Income exempt from federal taxation .........................................

2j.

j. Total ............................................................................................

k. Ratio in Rhode Island. Line 2j, column A divided by line 2j, column B.............................................................................

2k.

_._ _ _ _ _ _

Salaries & Wages 3. a.Salaries and wages paid or incurred - (see instructions)............

3a.

b. Ratio in Rhode Island. Line 3a, column A divided by line 3a, column B...........................................................................

_._ _ _ _ _ _

3b.

Ratio

4 Total of Rhode Island Ratios shown on lines 1f, 2k and 3b ...................................................................................................

4.

_._ _ _ _ _ _

5. Apportionment Ratio. Line 4 divided by 3 or by the number of ratios. Enter here and on page 1, Schedule A, line 7 .........

5.

_._ _ _ _ _ _

1

1 2

2 3

3