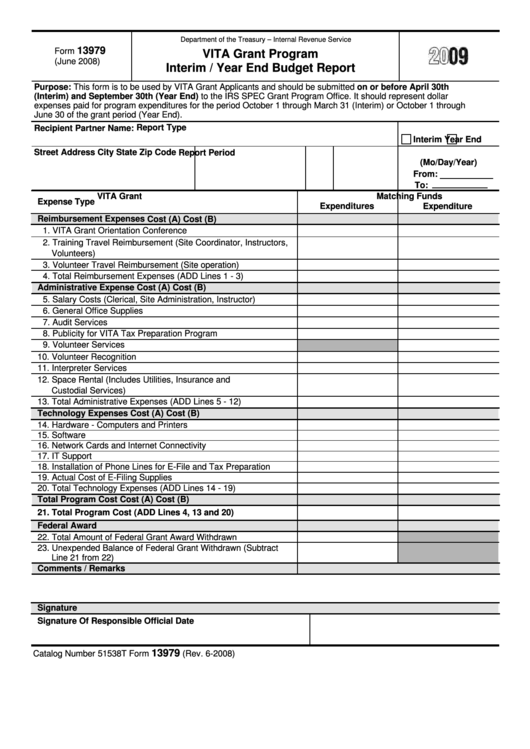

Department of the Treasury – Internal Revenue Service

13979

Form

VITA Grant Program

(June 2008)

Interim / Year End Budget Report

Purpose: This form is to be used by VITA Grant Applicants and should be submitted on or before April 30th

(Interim) and September 30th (Year End) to the IRS SPEC Grant Program Office. It should represent dollar

expenses paid for program expenditures for the period October 1 through March 31 (Interim) or October 1 through

June 30 of the grant period (Year End).

Report Type

Recipient Partner Name:

Interim

Year End

Street Address

City

State Zip Code

Report Period

(Mo/Day/Year)

From:

To:

VITA Grant

Matching Funds

Expense Type

Expenditures

Expenditure

Reimbursement Expenses

Cost (A)

Cost (B)

1. VITA Grant Orientation Conference

2. Training Travel Reimbursement (Site Coordinator, Instructors,

Volunteers)

3. Volunteer Travel Reimbursement (Site operation)

4. Total Reimbursement Expenses (ADD Lines 1 - 3)

Administrative Expense

Cost (A)

Cost (B)

5. Salary Costs (Clerical, Site Administration, Instructor)

6. General Office Supplies

7. Audit Services

8. Publicity for VITA Tax Preparation Program

9. Volunteer Services

10. Volunteer Recognition

11. Interpreter Services

12. Space Rental (Includes Utilities, Insurance and

Custodial Services)

13. Total Administrative Expenses (ADD Lines 5 - 12)

Technology Expenses

Cost (A)

Cost (B)

14. Hardware - Computers and Printers

15. Software

16. Network Cards and Internet Connectivity

17. IT Support

18. Installation of Phone Lines for E-File and Tax Preparation

19. Actual Cost of E-Filing Supplies

20. Total Technology Expenses (ADD Lines 14 - 19)

Total Program Cost

Cost (A)

Cost (B)

21. Total Program Cost (ADD Lines 4, 13 and 20)

Federal Award

22. Total Amount of Federal Grant Award Withdrawn

23. Unexpended Balance of Federal Grant Withdrawn (Subtract

Line 21 from 22)

Comments / Remarks

Signature

Signature Of Responsible Official

Date

13979

Catalog Number 51538T

Form

(Rev. 6-2008)

1

1 2

2 3

3 4

4