Page 4 of 6

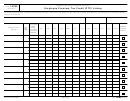

Section IV: Advisee Information and Summary or Schedule of Tax Treatment

(Continued)

First Name

Name (Last/Entity)

Taxpayer Identification Number (TIN)

10)

Street Address

City

State

Zip

Date Entered into Transaction

Amount Invested

Summary or Schedule of the Tax Treatment that Advisee is Expected or

Associated Documents, such as Exhibit

Intended to Derive from Participation in Reportable Transaction

and/or Bates Numbers (Optional)

Name (Last/Entity)

First Name

Taxpayer Identification Number (TIN)

11)

Street Address

City

State

Zip

Date Entered into Transaction

Amount Invested

Summary or Schedule of the Tax Treatment that Advisee is Expected or

Associated Documents, such as Exhibit

Intended to Derive from Participation in Reportable Transaction

and/or Bates Numbers (Optional)

Privacy Act Notice and Paperwork Reduction Act Notice

We ask for the information on this form to carry out the Internal Revenue laws of the United States. We need it to ensure

that you are complying with these laws. Our authority to ask for this information is Internal Revenue Code sections 6112

and 6708 and their regulations, which require you to furnish this information to us within 20 business days after we

request it from you in writing. Section 6109 requires that you provide your identifying number on what you file; this is so

that we can properly process your filed documents. Use of this form is optional, but providing the information requested on

this form is mandatory. We may disclose this information to the Department of Justice for civil and criminal litigation, and

to other federal agencies as provided by law. We may give it to cities, states, the District of Columbia, and U.S.

commonwealths or possessions to carry out their tax laws. We may also disclose this information to other countries under

a tax treaty, to federal and state agencies to enforce federal nontax criminal law, or to federal law enforcement and

intelligence agencies to combat terrorism. Failure to maintain and furnish this information as required, or providing false or

incomplete information, may subject you to penalties.

The collection of information referenced in this form have been previously reviewed and approved by the Office of

Management and Budget (OMB) as part of the promulgation of § 6112 in accordance with the Paperwork Reduction Act

(44 U.S.C. 3507) under control number 1545-1686. Material Advisors are required to maintain this information. If

requested, Material Advisors are required to provide this information to the Internal Revenue Service. The revenue

procedure merely provides a format for material advisors to use in complying with the requirements of § 6112. This form is

not required.

An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless the

collection of information displays a valid OMB control number. Books or records relating to a collection of information must

be retained as long as their contents may become material in the administration of any internal revenue law. Generally,

tax returns and return information are confidential, as required by § 6103. The estimated annual burden per recordkeeper

for this collection of information is 100 hours and the estimated number of recordkeepers is 500.

13976

Catalog Number 51488Y

Form

(Rev. 04-2008)

1

1 2

2 3

3 4

4 5

5 6

6