Page 6 of 6

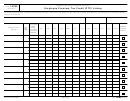

Summary or Schedule of the Tax Treatment that Advisee

Section IV - Advisee Information and Summary or

is Expected or Intended to Derive From Participation in

Schedule of Tax Treatment

Reportable Transaction. Enter a summary or a schedule of

the tax treatment that each advisee is expected or intended to

Provide the following information for each person or entity for

derive from participation in each reportable transaction.

which you acted in your capacity as a material advisor with

respect to the reportable transaction described on this Form

The tax treatment that an advisee is intended to derive is the

(or similar form). Use more than one page if necessary.

purported or claimed Federal tax treatment of the transaction.

Individuals. If the advisee is an individual, enter the last

If the information required exceeds the space provided, follow

name and first name, the complete address, the social security

the procedures under How to Complete the Form.

number, the date the person entered into the transaction (if

known), and the amount of money the person invested in the

Associated Documents. This column is optional. If there are

reportable transaction (if known).

any documents or exhibits associated with the advisee for the

reportable transaction described on this Form (or similar form)

Entities. If the advisee is an entity, enter the full name of the

that are labeled, the Bates numbers or other information

entity as shown on its income tax return, the complete

identifying the associated documents may be entered in this

address, the employer identification number, the date the

column.

entity entered into the transaction (if known), and the amount

of money the entity invested in the reportable transaction (if

known).

13976

Catalog Number 51488Y

Form

(Rev. 04-2008)

1

1 2

2 3

3 4

4 5

5 6

6