Form Sc1120-T - South Carolina Application For Automatic Extension Of Time To File Corporation Tax Return

ADVERTISEMENT

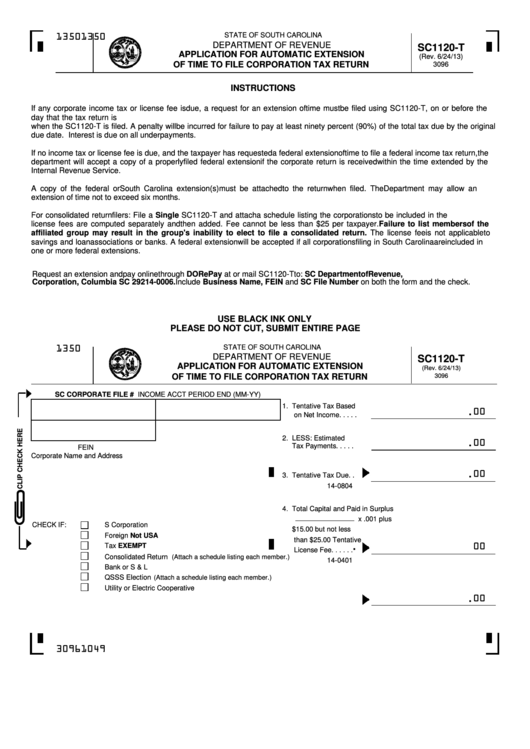

STATE OF SOUTH CAROLINA

1350

1350

DEPARTMENT OF REVENUE

SC1120-T

APPLICATION FOR AUTOMATIC EXTENSION

(Rev. 6/24/13)

OF TIME TO FILE CORPORATION TAX RETURN

3096

INSTRUCTIONS

If any corporate income tax or license fee is due, a request for an extension of time must be filed using SC1120-T, on or before the

day that the tax return is due. No refund will be issued until a return is filed. Any amounts shown to be due on this form must be paid

when the SC1120-T is filed. A penalty will be incurred for failure to pay at least ninety percent (90%) of the total tax due by the original

due date. Interest is due on all underpayments.

If no income tax or license fee is due, and the taxpayer has requested a federal extension of time to file a federal income tax return, the

department will accept a copy of a properly filed federal extension if the corporate return is received within the time extended by the

Internal Revenue Service.

A copy of the federal or South Carolina extension(s) must be attached to the return when filed. The Department may allow an

extension of time not to exceed six months.

For consolidated return filers: File a Single SC1120-T and attach a schedule listing the corporations to be included in the return. The

license fees are computed separately and then added. Fee cannot be less than $25 per taxpayer. Failure to list members of the

affiliated group may result in the group's inability to elect to file a consolidated return. The license fee is not applicable to

savings and loan associations or banks. A federal extension will be accepted if all corporations filing in South Carolina are included in

one or more federal extensions.

Request an extension and pay online through DORePay at or mail SC1120-T to: SC Department of Revenue,

Corporation, Columbia SC 29214-0006. Include Business Name, FEIN and SC File Number on both the form and the check.

USE BLACK INK ONLY

PLEASE DO NOT CUT, SUBMIT ENTIRE PAGE

STATE OF SOUTH CAROLINA

1350

DEPARTMENT OF REVENUE

SC1120-T

APPLICATION FOR AUTOMATIC EXTENSION

(Rev. 6/24/13)

OF TIME TO FILE CORPORATION TAX RETURN

3096

SC CORPORATE FILE #

INCOME ACCT PERIOD END (MM-YY)

1. Tentative Tax Based

.

00

on Net Income. . . . .

2. LESS: Estimated

.

00

Tax Payments. . . . .

FEIN

Corporate Name and Address

.

00

3. Tentative Tax Due. .

14-0804

4. Total Capital and Paid in Surplus

x .001 plus

CHECK IF:

S Corporation

$15.00 but not less

Foreign Not USA

than $25.00 Tentative

.

Tax EXEMPT

00

License Fee. . . . . .

Consolidated Return

(Attach a schedule listing each member.)

14-0401

Bank or S & L

QSSS Election

(Attach a schedule listing each member.)

Utility or Electric Cooperative

.

00

5. Balance Remitted. .

30961049

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1