Form 51a115 - Sales And Use Tax Order Form

ADVERTISEMENT

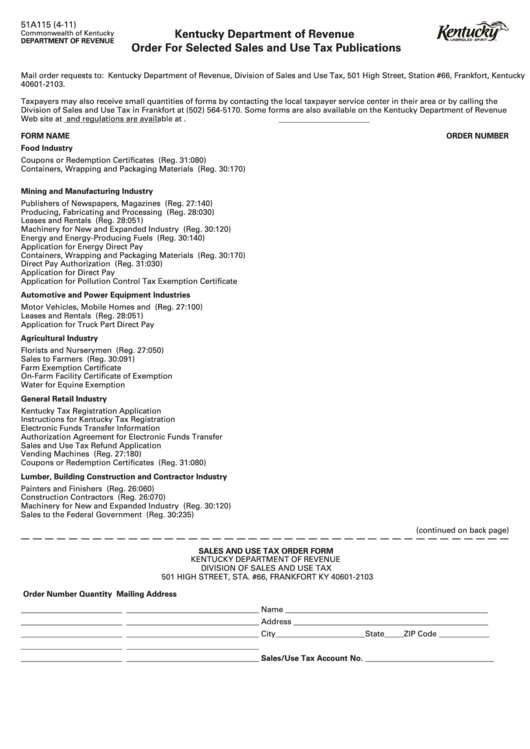

51A115 (4-11)

Kentucky Department of Revenue

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Order For Selected Sales and Use Tax Publications

Mail order requests to: Kentucky Department of Revenue, Division of Sales and Use Tax, 501 High Street, Station #66, Frankfort, Kentucky

40601-2103.

Taxpayers may also receive small quantities of forms by contacting the local taxpayer service center in their area or by calling the

Division of Sales and Use Tax in Frankfort at (502) 564-5170. Some forms are also available on the Kentucky Department of Revenue

Web site at and regulations are available at

FORM NAME

ORDER NUMBER

Food Industry

Coupons or Redemption Certificates ......................................................................................................................................... (Reg. 31:080)

Containers, Wrapping and Packaging Materials ....................................................................................................................... (Reg. 30:170)

Mining and Manufacturing Industry

Publishers of Newspapers, Magazines ...................................................................................................................................... (Reg. 27:140)

Producing, Fabricating and Processing ..................................................................................................................................... (Reg. 28:030)

Leases and Rentals ...................................................................................................................................................................... (Reg. 28:051)

Machinery for New and Expanded Industry .............................................................................................................................. (Reg. 30:120)

Energy and Energy-Producing Fuels .......................................................................................................................................... (Reg. 30:140)

Application for Energy Direct Pay .............................................................................................................................................. 51A109

Containers, Wrapping and Packaging Materials ....................................................................................................................... (Reg. 30:170)

Direct Pay Authorization .............................................................................................................................................................. (Reg. 31:030)

Application for Direct Pay ........................................................................................................................................................... 51A112

Application for Pollution Control Tax Exemption Certificate .................................................................................................... 51A216

Automotive and Power Equipment Industries

Motor Vehicles, Mobile Homes and Trailers............................................................................................................................... (Reg. 27:100)

Leases and Rentals ...................................................................................................................................................................... (Reg. 28:051)

Application for Truck Part Direct Pay .......................................................................................................................................... 51A160

Agricultural Industry

Florists and Nurserymen ............................................................................................................................................................ (Reg. 27:050)

Sales to Farmers .......................................................................................................................................................................... (Reg. 30:091)

Farm Exemption Certificate ........................................................................................................................................................ 51A158

On-Farm Facility Certificate of Exemption ................................................................................................................................. 51A159

Water for Equine Exemption ....................................................................................................................................................... 51A157

General Retail Industry

Kentucky Tax Registration Application ....................................................................................................................................... 10A100

Instructions for Kentucky Tax Registration ................................................................................................................................. 10A100-I

Electronic Funds Transfer Information ....................................................................................................................................... 10F075

Authorization Agreement for Electronic Funds Transfer ........................................................................................................... 10A070

Sales and Use Tax Refund Application ....................................................................................................................................... 51A209

Vending Machines ....................................................................................................................................................................... (Reg. 27:180)

Coupons or Redemption Certificates ......................................................................................................................................... (Reg. 31:080)

Lumber, Building Construction and Contractor Industry

Painters and Finishers ................................................................................................................................................................. (Reg. 26:060)

Construction Contractors ............................................................................................................................................................ (Reg. 26:070)

Machinery for New and Expanded Industry .............................................................................................................................. (Reg. 30:120)

Sales to the Federal Government ............................................................................................................................................... (Reg. 30:235)

(continued on back page)

SALES AND USE TAX ORDER FORM

KENTUCKY DEPARTMENT OF REVENUE

DIVISION OF SALES AND USE TAX

501 HIGH STREET, STA. #66, FRANKFORT KY 40601-2103

Order Number

Quantity

Mailing Address

__________________________

__________________________________

Name ____________________________________________________

__________________________

__________________________________

Address __________________________________________________

__________________________

__________________________________

City_______________________State_____ZIP Code _____________

__________________________

__________________________________

__________________________

__________________________________

Sales/Use Tax Account No. _________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2