Instructions for Form 72A181, Schedule 15B—Terminal Operator Schedule of Disbursement

Schedule 15B provides detail in support of the amount(s) shown as disbursements on the terminal report.

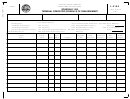

Identifying Information

Company Name

and FEIN:

Enter the name and FEIN for the terminal operator shown on the terminal report.

Terminal Code:

Use the IRS Terminal Control Number

Product Code:

Enter the appropriate code on page 1. See Kentucky Revenue Web site for a list of product codes:

Column Instructions

Columns(1) and (2):

Carrier—Enter the name and FEIN of the company that transported the product into the terminal.

Column (3):

Mode of Transport—Enter the mode of transport. Use one of the following:

J=Truck

R=Rail

B=Barge

PL=Pipeline

S=Ship (Great Lakes or ocean marine vessel)

BA=Book Adjustment

ST=Stationary Transfer

CE=Summary

RT=Removal from Terminal (other than by truck or rail for sale or consumption)

Column (4):

Destination State—Enter the state, territory, or foreign country to which any reportable motor fuel is directed for delivery into any storage facility, receptacle,

container, or any type of transportation equipment, for purpose of resale or use.

Column (5) and (6):

Position Holder—Enter the name and FEIN of the company that owns the product as reflected on the records of the terminal operators (Same as the

Federal definition).

Column (7):

Date Shipped—Enter the date the carrier leaves the terminal with the product.

Column (8):

Document Number—Enter the identifying number from the document issued at the terminal when product was removed over the rack. In the case of

pipeline or barge movements, it is the pipeline or barge ticket number.

Column (9):

Net Gallons—Enter the net amount of gallons withdrawn from the terminal. The total of all amounts entered in this column should agree to the amount

shown for disbursement on the terminal report.

Column (10):

Gross Gallons—Enter the gross amount of gallons withdrawn from the terminal.

.

1

1 2

2