INSTRUCTIONS

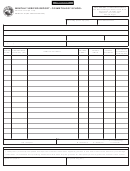

This report must be completed by all licensed gasoline and special fuels dealers who produce, refine, manufacture or compound gasoline or

special fuels in Kentucky and store in marine or pipeline terminal storage facilities. File this report and all supporting schedules as a supplement

to Form 72A089 and 72A138, Licensed Gasoline and Special Fuels Dealer’s Monthly Reports, on or before the 25th day of the month

following the month for which the report is prepared. A separate terminal storage report is required for each terminal location.

Gasoline fuels to be reported on this report include any and all grades of gasoline, gasoline-alcohol blend, alcohol or any fuel purchased and

blended with gasoline usable in internal combustion engines for the generation of power.

Special fuels to be reported on this return include all diesel fuel oils, kerosene blended with special fuels, kerosene sold to be used as a motor

fuel, and all other combustible gases and liquids capable of being used for the generation of power in an internal combustion engine to propel

vehicles of any kind upon the public highways, except that it does not include gasoline, liquefied petroleum gas, aviation jet fuel or nonhighway

kerosene.

All additions or disbursements of gallonage must be adjusted to 60 degrees Fahrenheit before being entered on the terminal storage report.

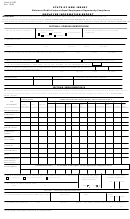

Licensed gasoline and special fuels dealers are required to keep all records relating to receipts, production, refining, manufacture, compounding,

use, sale, distribution and delivery of gasoline and special fuels for a period of five years. These records include invoices, bills of lading,

delivery tickets or other documentation which pertain to a dealer’s activity.

Telephone reference numbers for your convenience:

(1) Forms

(502) 564-3853

(2) License and Bonding (502) 564-3853

(3) Report Information

(502) 564-3853

General Correspondence:

Kentucky Department of Revenue

Division of Miscellaneous Taxes

Motor Fuels Tax Compliance Section

P.O. Box 1303, Station # 63

Frankfort, Kentucky 40602-1303

1

1 2

2