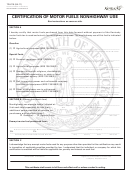

Form 72a110 - Certification Of Motor Fuels Nonhighway Use Page 2

ADVERTISEMENT

iMPORTANT iNFORMATiON

Only purchases from licensed Kentucky motor fuels dealers are tax-free.

No tax-free purchases are allowed from retail filling stations.

Special fuels for nonhighway use include undyed fuel and its blends.

iNsTRUcTiONs

Anyone who purchases tax-free motor fuels from a licensed Kentucky motor fuels dealer must complete this

certificate. Valid certificates must provide data for sections A, B and C. The completed certificate is retained

by the motor fuels dealer and allows that dealer to take credit for gallons sold to the person listed on the

reverse side.

section A, item (1)

To qualify under item (1), the gasoline must be sold exclusively for the purpose of operating or propelling

stationary engines or tractors for agricultural purposes. The purchaser must hold a valid Kentucky Motor

Fuels Tax Refund Permit with a prefix of A, D, E or g. The purchaser's permit number must be provided on

this line.

section A, item (2)

To qualify under item (2), the special fuel must be delivered into a tank which has no dispensing outlet and

used exclusively to heat a personal residence. The purchaser's Driver's license Number must be provided on

this line. Purchases of special fuel used to heat a commercial building qualify under item (6).

section A, item (3)

To qualify under item (3), the special fuel must be sold exclusively for the purpose of operating or propelling

stationary engines or tractors for agricultural purposes. The purchaser must hold a valid Kentucky Motor

Fuels Tax Refund Permit with a prefix of B, D, F or g. The purchaser's permit number must be provided on

this line.

section A, item (4)

To qualify under item (4), the special fuel must be delivered into and used from a nonhighway use storage

tank. The customer must provide proof of their sales and use tax exempt status by providing the exempt

number on this line or attaching a copy of the letter issued by the Kentucky Department of Revenue. Fuel

used in licensed motor vehicles on the public highways is taxable.

section A, item (5)

To qualify under item (5), the special fuel must be delivered to a railroad company principally engaged in

commercial transportation of property for others or in the conveyance of persons used exclusively to power

locomotives and unlicensed company vehicles or equipment for nonhighway use. The railroad company must

hold a valid Kentucky Motor Fuels Tax Refund Permit. The purchaser's permit number must be provided on

this line. Fuel used in licensed motor vehicles on the public highways is taxable.

section A, item (6)

To qualify under item (6), the special fuel must be used in a nonhighway use purpose. Fuel used in licensed

motor vehicles on the public highways is taxable. The customer must either pay the sales tax on the purchase

or provide proof of their sales and use tax exempt status by providing the exemption number and completing

the sales/use exemption certificate or provide dealer with a copy of their Energy Direct Pay Authorization.

The purchaser must hold a valid Kentucky Motor Fuels Tax Refund Permit with a prefix of c, E, F or g. The

purchaser's permit number must be provided on this line.

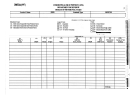

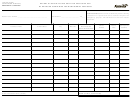

section B

Complete the address of the nonhighway storage tank location in which the motor fuel is placed. If multiple

locations, list additional tank information:

Tank

Type of Fuel

Capacity

Street

City

State

ZIP Code

Gas Special Fuel

Gas Special Fuel

Gas Special Fuel

Gas Special Fuel

Gas Special Fuel

Gas Special Fuel

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2