Instructions For Form Mfut-15 - State Of Illinois Page 2

ADVERTISEMENT

Column H - For each jurisdiction and fuel type, divide the

Column M - If your return is filed late, you owe interest to each

taxable miles (Column G) by the average miles per gallon

IFTA jurisdiction where tax is due. To compute the proper

(Column C).

interest, multiply the tax due (Column L) for that jurisdiction by

1% (.01) per month. A fraction of a month is considered a

Column I - Tax-paid gallons include fuel you purchased from

whole month. If you have a credit in Column L, do not compute

service stations and withdrew from tax-paid bulk storage in the

interest for that jurisdiction and fuel type.

specified jurisdiction during the reporting period.

Step 4: Figure your totals

Column J - Subtract the tax-paid gallons (Column I) from the

taxable gallons (Column H) for each IFTA jurisdiction. If the

Line 2 - If you filed after the due date and have a balance due,

result is a credit, write the amount in brackets.

multiply Line 1 by 10 percent (.10). Write this amount or $50,

whichever is greater, on Line 2. If you filed after the due date

Column K - Using the appropriate quarter’s IFTA Fuel Tax Rate

and have a credit due, write $50 on Line 2. Penalty is also

Sheet, write the fuel tax rate for each IFTA jurisdiction entered

assessed for taxes that are not paid in full.

in Column D.

Line 5 - Any prior quarter’s balance due or credit will be

Column L - Multiply the net taxable gallons (Column J) by the

preprinted on this line. Please contact us if you have questions

tax rate for each IFTA jurisdiction (Column K). If the result is a

about this amount.

credit, write the amount in brackets.

Line 6 - We will automatically issue refunds for overpayments

of $25 or more. We will credit overpayments of less than $25 to

your next quarter’s return.

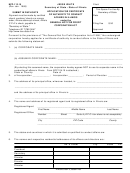

Surcharge Example and Instructions

Some jurisdictions impose an additional tax (surcharge) that is not collected at the pump. If you traveled in a jurisdiction that

imposes a surcharge (see IFTA Fuel Tax Rate Sheet), you must complete two lines in Step 3 for that jurisdiction. See the example

and instructions below.

Example

D

E

F

G

H

I

J

K

L

M

Juris-

Fuel

Total

Taxable

Taxable

Tax-paid

Net taxable

Tax

Tax/credit

Interest

diction

type

miles

miles

gallons

gallons

gallons

rate

due

due

(D, G, P ,

(Column G divided

(Column H minus

(Column J times

GH, NG)

by Column C)

Column I)

Column K)

1

IN

D

30,000

30,000

5,700

4,500

1,200

.1600

$192.00

$

2

Surcharge

5,700

5,700

.1100

$627.00

$

Instructions

Line 1 - Complete Columns D through M for the applicable jurisdiction.

Line 2 - Write “surcharge” through Columns D and E. Do not complete Columns F, G, and I (you may block them out). Copy the amount

from Line 1, Column H, to Line 2, Columns H and J. Write the surcharge tax rate in Column K and figure Columns L and M.

All Other Jurisdiction Travel Example

If you traveled in a jurisdiction that does not collect motor fuel use tax for a specific fuel type (listed as “N/A” on the IFTA Fuel Tax

Rate Sheet) or a non-IFTA jurisdiction, you must report these miles. Write the abbreviation “OM” (other miles) in Column D. Write

the abbreviation for each fuel type consumed in Column E. In Column F report, by fuel type, all miles driven. Do not complete

Columns G through M (you may block them out). See the example below.

Example

D

E

F

G

H

I

J

K

L

M

Juris-

Fuel

Total

Taxable

Taxable

Tax-paid

Net taxable

Tax

Tax/credit

Interest

diction

type

miles

miles

gallons

gallons

gallons

rate

due

due

(D, G, P ,

(Column G divided

(Column H minus

(Column J times

GH, NG)

by Column C)

Column I)

Column K)

OM

D

30,000

$

$

OM

G

26,200

$

$

OM

P

4,350

$

$

Page 2 of 2

MFUT-15 Instructions (R-9/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6