2

Form 8328 (Rev. 9-2011)

Page

General Instructions

5. Enterprise zone facility bonds taken into account under Regulations

section 1.1394-1(m)(3).

Section references are to the Internal Revenue Code unless otherwise

6. Tax-Exempt Economic Development Bonds for the District of

noted.

Columbia Enterprise Zone, section 1400A. Include any Tax-Exempt

Purpose of Form

Economic Development Bond carryforward on Line 10j.

• An election under section 142(k) may be made by the state for

Form 8328 is filed by the issuing authority of private activity bonds to

qualified public educational facility bonds.

elect to carry forward its unused volume cap for one or more

carryforward purposes (see section 146(f)). If the election is made,

Specific Instructions

bonds issued with respect to a specified carryforward purpose are not

subject to the volume cap under section 146(a) during the 3 calendar

Parts I and II of this form must be completed to properly elect the

years following the calendar year in which the carryforward arose, but

carryforward provisions under section 146(f).

only to the extent that the amount of such bonds does not exceed the

Parts I and III must be completed to properly elect the carryforward

amount of the carryforward elected for that purpose.

provisions under section 142(k).

Also, Form 8328 is used by a state to carry forward the unused

Part I. Reporting Authority

volume cap under section 142(k). A state may elect to carry forward an

Name. Enter the name of the state if filing under section 142(k). For all

unused limitation for any calendar year for 3 calendar years following the

others, enter the name of the entity issuing the bonds.

calendar year in which the unused limitation arose under rules similar to

Report number. This line is for IRS use only. Do not make an entry.

the rules of section 146(f). However, this election can only be made for

the issuance of qualified public educational facility bonds. For

Part II. Unused Volume Cap and Carryforward Under

definitions related to qualified public educational facilities, see section

Section 146(f)

142(k).

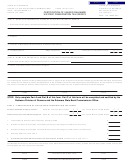

Computation of Unused Volume Cap

When To File

Line 1. Enter the issuing authority’s volume cap under section 146 for

Form 8328 must be filed by the earlier of: (1) February 15 of the

the current calendar year. Take into account any reduction in the

calendar year following the year in which the excess amount arises, or

amount of the volume cap under section 25(f) (relating to the reduction

(2) the date of issue of bonds issued pursuant to the carryforward

in the aggregate amount of qualified mortgage bonds where certain

election.

requirements are not met). See section 146(n)(2).

Once Form 8328 is filed, the issuer may not revoke the carryforward

Line 2. Enter the total amount of private activity bonds issued by the

election or amend the carryforward amounts shown on this form.

issuing authority during the current calendar year that are taken into

Errors on this form cannot be corrected through an amended filing.

account under section 146. See Bonds Taken Into Account Under

The issuer may file a Voluntary Closing Agreement Program (VCAP)

Section 146.

request to correct mathematical, typographical, and similar errors. See

Line 3. Enter the total amount of qualified mortgage bonds the issuing

Notice 2008-31, 2008-11 I.R.B. 592, and IRM 7.2.3 for more

authority has elected not to issue under section 25(c)(2)(A)(ii) during the

information about VCAP.

current calendar year, plus the reduction under section 25(f) for that

Where To File

calendar year. See section 146(n).

Line 4. Enter the total amount of volume cap allocated by the issuer

File Form 8328 with the Department of the Treasury, Internal Revenue

to the private activity portion of governmental bonds. See sections

Service Center, Ogden, UT 84201.

141(b)(5) and 146(m).

Bonds Taken Into Account Under

Purpose and Amount of Each Carryforward

Section 146

Enter the amount of unused volume cap the issuer elects to carry

All private activity tax-exempt bonds issued during a calendar year are

forward for each carryforward purpose and the total carryforward

taken into account under section 146 except:

amount.

1. Qualified veterans' mortgage bonds.

Part III. Unused Volume Cap and Carryforward Under

2. Qualified section 501(c)(3) bonds.

Section 142(k) (Qualifying Public Educational Facility

3. Exempt facility bonds for governmentally owned airports, docks

Bonds)

and wharves, and environmental enhancements of hydroelectric

generating facilities; also exempt facility bonds for qualified public

Complete lines 12 through 15 to compute the amount elected to carry

educational facilities, qualified green building and sustainable design

forward under section 142(k).

projects and qualified highway or surface freight transfer facilities.

Signature

4. 75% of any exempt facility bonds for privately owned high-speed

Form 8328 must be signed by an authorized public official responsible

intercity rail facilities; 100% if governmentally owned.

for carrying forward unused volume cap.

5. Exempt facilities bonds for governmentally owned solid waste

disposal facilities. See section 146(h).

Paperwork Reduction Act Notice. We ask for the information on this

6. Bonds issued pursuant to a carryforward election. See section

form to carry out the Internal Revenue laws of the United States. You

146(f)(3)(A).

are required to give us the information. We need it to ensure that you are

7. Certain current refundings. See section 146(i).

complying with these laws.

8. Certain bonds issued by Indian tribal governments for tribal

You are not required to provide the information requested on a form

manufacturing facilities. See section 7871(c)(3).

that is subject to the Paperwork Reduction Act unless the form displays

9. Tribal Economic Development Bonds, section 7871(f).

a valid OMB control number. Books or records relating to a form or its

10. Gulf Opportunity Zone bonds, Midwestern Disaster Area bonds,

instructions must be retained as long as their contents may become

Hurricane Ike Disaster Area bonds, section 1400N.

material in the administration of any Internal Revenue law. Generally, tax

11. New York Liberty Zone bonds, section 1400L.

returns and return information are confidential, as required by section

12. Enterprise Zone Facility bonds, section 1394(f).

6103.

Note. Enterprise Zone Facility bonds under section 1394(a)-(e) are

The time needed to complete and file this form will vary depending on

subject to section 146. See Line 10j of Form 8328.

individual circumstances. The estimated average time is:

In addition, the private activity portion of governmental bonds is

Recordkeeping

.

.

.

.

.

.

.

.

.

.

.

.

7 hr., 24 min.

taken into account to the extent that the nonqualified amount exceeds

Learning about the law or the form .

.

.

.

.

.

2 hr., 47 min.

$15 million. See sections 141(b)(5) and 146(m).

Preparing and sending

Bonds Eligible for Carryforward Elections

the form to the IRS .

.

.

.

.

.

.

.

.

.

.

3 hr., 1 min.

• An election under section 146(f) may be made by the issuing authority

If you have comments concerning the accuracy of these time

for only the following types of tax-exempt bonds:

estimates or suggestions for making this form simpler, we would be

1. Qualified student loan bonds.

happy to hear from you. You can write to the Internal Revenue Service,

2. Qualified mortgage bonds (or mortgage credit certificates).

Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111

3. Qualified redevelopment bonds.

Constitution Ave. NW, IR-6526, Washington, DC 20224. Do not send the

4. Exempt facility bonds taken into account under section 142(a).

form to this address. Instead, see Where To File.

1

1 2

2