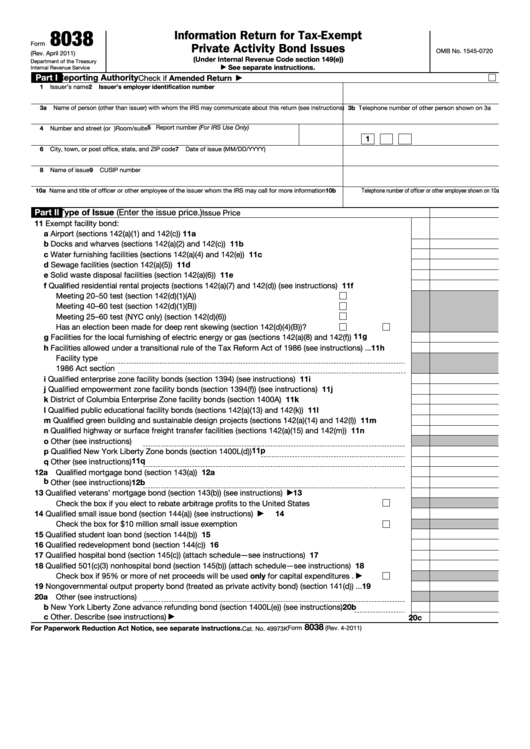

Form 8038 - Information Return For Tax-Exempt Private Activity Bond Issues

ADVERTISEMENT

8038

Information Return for Tax-Exempt

Form

Private Activity Bond Issues

OMB No. 1545-0720

(Rev. April 2011)

(Under Internal Revenue Code section 149(e))

Department of the Treasury

See separate instructions.

Internal Revenue Service

▶

Part I

Reporting Authority

Check if Amended Return

▶

1

2

Issuer’s employer identification number

Issuer’s name

3a

Name of person (other than issuer) with whom the IRS may communicate about this return (see instructions)

3b Telephone number of other person shown on 3a

5 Report number (For IRS Use Only)

4

Number and street (or P.O. box if mail is not delivered to street address)

Room/suite

1

6

City, town, or post office, state, and ZIP code

7

Date of issue (MM/DD/YYYY)

8

Name of issue

9

CUSIP number

10a Name and title of officer or other employee of the issuer whom the IRS may call for more information

10b Telephone number of officer or other employee shown on 10a

Part II

Type of Issue (Enter the issue price.)

Issue Price

11

Exempt facility bond:

a Airport (sections 142(a)(1) and 142(c)) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11a

b Docks and wharves (sections 142(a)(2) and 142(c))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11b

c Water furnishing facilities (sections 142(a)(4) and 142(e))

11c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

d Sewage facilities (section 142(a)(5))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11d

e Solid waste disposal facilities (section 142(a)(6)) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

11e

f

11f

Qualified residential rental projects (sections 142(a)(7) and 142(d)) (see instructions)

.

.

.

.

.

Meeting 20–50 test (section 142(d)(1)(A))

.

.

.

.

.

.

.

.

.

.

.

.

Meeting 40–60 test (section 142(d)(1)(B))

.

.

.

.

.

.

.

.

.

.

.

.

Meeting 25–60 test (NYC only) (section 142(d)(6)) .

.

.

.

.

.

.

.

.

.

Has an election been made for deep rent skewing (section 142(d)(4)(B))? .

.

Yes

No

11g

g Facilities for the local furnishing of electric energy or gas (sections 142(a)(8) and 142(f)) .

.

.

.

h Facilities allowed under a transitional rule of the Tax Reform Act of 1986 (see instructions) .

.

.

11h

Facility type

1986 Act section

i

Qualified enterprise zone facility bonds (section 1394) (see instructions)

.

.

.

.

.

.

.

.

.

11i

j

11j

Qualified empowerment zone facility bonds (section 1394(f)) (see instructions) .

.

.

.

.

.

.

k District of Columbia Enterprise Zone facility bonds (section 1400A) .

11k

.

.

.

.

.

.

.

.

.

.

l

Qualified public educational facility bonds (sections 142(a)(13) and 142(k))

.

.

.

.

.

.

.

.

11l

m Qualified green building and sustainable design projects (sections 142(a)(14) and 142(l)) .

.

.

.

11m

n Qualified highway or surface freight transfer facilities (sections 142(a)(15) and 142(m)) .

11n

.

.

.

.

o Other (see instructions)

11p

p Qualified New York Liberty Zone bonds (section 1400L(d))

11q

q Other (see instructions)

12a Qualified mortgage bond (section 143(a))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12a

b Other (see instructions)

12b

13

13

Qualified veterans’ mortgage bond (section 143(b)) (see instructions)

.

.

.

.

.

.

.

.

.

▶

Check the box if you elect to rebate arbitrage profits to the United States

.

.

.

.

.

14

Qualified small issue bond (section 144(a)) (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

14

▶

Check the box for $10 million small issue exemption

.

.

.

.

.

.

.

.

.

.

.

.

15

15

Qualified student loan bond (section 144(b))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

Qualified redevelopment bond (section 144(c))

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

17

Qualified hospital bond (section 145(c)) (attach schedule—see instructions) .

.

.

.

.

.

.

.

17

18

18

Qualified 501(c)(3) nonhospital bond (section 145(b)) (attach schedule—see instructions) .

.

.

.

Check box if 95% or more of net proceeds will be used only for capital expenditures .

▶

19

Nongovernmental output property bond (treated as private activity bond) (section 141(d))

.

.

.

19

20a Other (see instructions)

b New York Liberty Zone advance refunding bond (section 1400L(e)) (see instructions)

20b

c Other. Describe (see instructions)

20c

▶

8038

For Paperwork Reduction Act Notice, see separate instructions.

Form

(Rev. 4-2011)

Cat. No. 49973K

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3