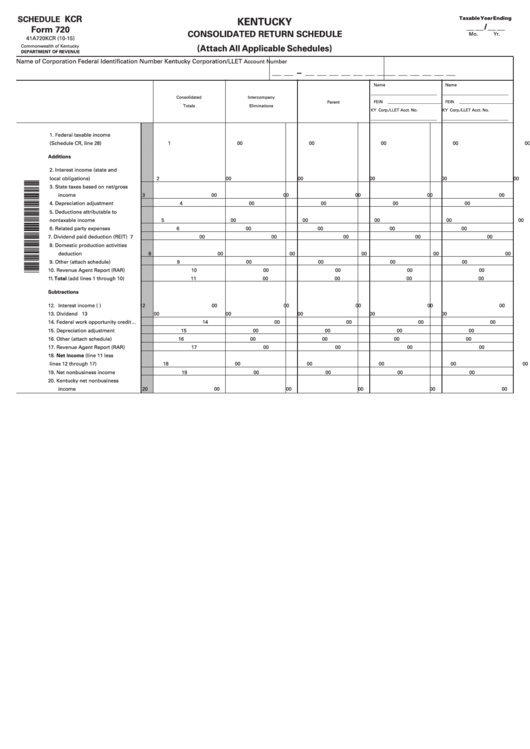

KCR

SCHEDULE

Taxable Year Ending

KENTUCKY

__ __ / __ __

Form 720

CONSOLIDATED RETURN SCHEDULE

Mo.

Yr.

41A720KCR (10-15)

(Attach All Applicable Schedules)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Name of Corporation

Federal Identification Number

Kentucky Corporation/LLET

Account Number

___ ___ — ___ ___ ___ ___ ___ ___ ___

___ ___ ___ ___ ___ ___

Name

Name

________________________________

________________________________

Consolidated

Intercompany

FEIN __________________________

FEIN __________________________

Parent

Totals

Eliminations

KY Corp./LLET Acct. No.

KY Corp./LLET Acct. No.

________________________________

________________________________

1. Federal taxable income

(Schedule CR, line 28) ...................

1

00

00

00

00

00

Additions

2. Interest income (state and

local obligations) ...........................

2

00

00

00

00

00

3. State taxes based on net/gross

income ............................................

3

00

00

00

00

00

4. Depreciation adjustment ...............

4

00

00

00

00

00

5. Deductions attributable to

nontaxable income ........................

5

00

00

00

00

00

6. Related party expenses .................

6

00

00

00

00

00

7. Dividend paid deduction (REIT)....

7

00

00

00

00

00

8. Domestic production activities

deduction .......................................

8

00

00

00

00

00

9. Other (attach schedule) .................

9

00

00

00

00

00

10. Revenue Agent Report (RAR) ........

10

00

00

00

00

00

11. Total (add lines 1 through 10) .......

11

00

00

00

00

00

Subtractions

12. Interest income (U.S. obligations)

12

00

00

00

00

00

13. Dividend income............................

13

00

00

00

00

00

14. Federal work opportunity credit ...

14

00

00

00

00

00

15. Depreciation adjustment ...............

15

00

00

00

00

00

16. Other (attach schedule) .................

16

00

00

00

00

00

17. Revenue Agent Report (RAR) ........

17

00

00

00

00

00

18. Net income (line 11 less

lines 12 through 17) .......................

18

00

00

00

00

00

19. Net nonbusiness income ..............

19

00

00

00

00

00

20. Kentucky net nonbusiness

income ............................................

20

00

00

00

00

00

1

1 2

2