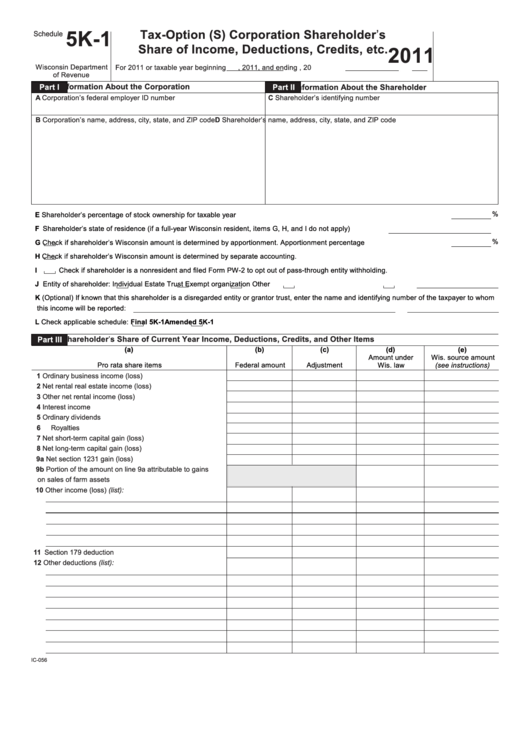

Schedule 5k-1 - Wisconsin Tax-Option (S) Corporation Shareholder'S Share Of Income, Deductions, Credits, Etc. - 2011

ADVERTISEMENT

5K-1

Tax-Option (S) Corporation Shareholder’s

Schedule

Share of Income, Deductions, Credits, etc.

2011

Wisconsin Department

For 2011 or taxable year beginning

, 2011, and ending

, 20

of Revenue

Information About the Corporation

Information About the Shareholder

Part I

Part II

C Shareholder’s identifying number

A Corporation’s federal employer ID number

D Shareholder’s name, address, city, state, and ZIP code

B Corporation’s name, address, city, state, and ZIP code

%

E Shareholder’s percentage of stock ownership for taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

F Shareholder’s state of residence (if a full-year Wisconsin resident, items G, H, and I do not apply) . . . . . . . . . .

%

G

Check if shareholder’s Wisconsin amount is determined by apportionment . Apportionment percentage . . . . . . . . . . . . . . . . .

H

Check if shareholder’s Wisconsin amount is determined by separate accounting .

I

Check if shareholder is a nonresident and filed Form PW-2 to opt out of pass-through entity withholding.

J Entity of shareholder:

Individual

Estate

Trust

Exempt organization

Other

K (Optional) If known that this shareholder is a disregarded entity or grantor trust, enter the name and identifying number of the taxpayer to whom

this income will be reported:

L Check applicable schedule:

Final 5K-1

Amended 5K-1

Part III

Shareholder’s Share of Current Year Income, Deductions, Credits, and Other Items

(a)

(b)

(c)

(d)

(e)

Wis . source amount

Amount under

Pro rata share items

Federal amount

Adjustment

Wis . law

(see instructions)

1

Ordinary business income (loss) . . . . . . . . . . . . . . . . . .

2

Net rental real estate income (loss) . . . . . . . . . . . . . . . .

3

Other net rental income (loss) . . . . . . . . . . . . . . . . . . . . .

4

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

Net short-term capital gain (loss) . . . . . . . . . . . . . . . . . .

8

Net long-term capital gain (loss) . . . . . . . . . . . . . . . . . . .

9a Net section 1231 gain (loss) . . . . . . . . . . . . . . . . . . . . . .

9b Portion of the amount on line 9a attributable to gains

on sales of farm assets . . . . . . . . . . . . . . . . . . . . . . . . . .

10

Other income (loss) (list):

11

Section 179 deduction . . . . . . . . . . . . . . . . . . . . . . . . . .

12

Other deductions (list):

IC-056

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2