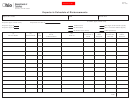

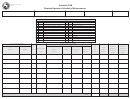

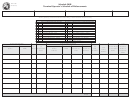

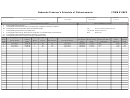

Form 83 Mfd - Nebraska Producer'S Schedule Of Disbursements Page 2

ADVERTISEMENT

INSTRUCTIONS FOR THE

NEBRASKA PRODUCER’S SCHEDULE OF DISBURSEMENTS, FORM 83 MFD

All Nebraska motor fuels tax reporting is submitted monthly through the Electronic Data Interchange

(EDI) process. This printed schedule is provided to illustrate the fields and types of information that

must be included for each load of fuel disbursed. The required information for some of the fields is

discussed below.

Column 2. Enter the name of the carrier hired to transport the fuel. If you use your own transport, enter

your name.

Column 4. Valid modes of transportation are:

J = Truck

PL = Pipeline

B = Barge

R = Railroad

GS = Gas Station

S = Ship

Column 5. The origin is the location from which the product was shipped. Enter the two-letter state

abbreviation or the IRS terminal code if appropriate.

Column 6. The destination is the location to which the product was transferred. All entries should be

either the IRS terminal code or the appropriate two-letter state abbreviation.

Column 9. Enter the bill of lading date from the manifest. This date should be identical to the date

indicated on the purchaser’s receipts schedule (MM/DD/YY). Do not use the invoice date if it is different

from the date of transfer of title or possession.

Column 10. The bill of lading number is the most commonly-reported document number and is normally

used to report full-load transactions. The document number must be identical to the document number

reported on the purchaser’s receipt schedule.

Filing Reminders

All gallons must be reported in gross gallons. While some states may allow, or even require, the reporting

of natural gasoline and ethanol in net temperature corrected gallons, Nebraska requires all reporting in

gross gallons.

There are two schedule codes unique to this return.

Schedule Code 6R - Use this schedule code to report the movement of product from your

finished goods inventory to another producer’s finished goods inventory located within Nebraska.

Provided the other producer is properly licensed, this is a tax-free transfer.

Schedule Code 10F - Use this schedule code to report the movement of product from your

finished goods inventory to your customer’s (a supplier) finished goods inventory located at a

Nebraska pipeline terminal. Provided the supplier is properly licensed, this is a tax-free transfer.

Valid Federal Employee Identification Numbers (FEINs) must be used for all fuel transfers in Nebraska.

.

Nebraska licensees and their correct FEINs are listed under

Licensees

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2