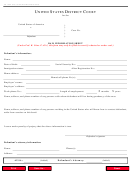

AO 133 (Rev. 12/09) Bill of Costs

U

S

D

C

NITED

TATES

ISTRICT

OURT

Witness Fees (computation, cf. 28 U.S.C. 1821 for statutory fees)

ATTENDANCE

SUBSISTENCE

MILEAGE

Total Cost

NAME , CITY AND STATE OF RESIDENCE

Each Witness

Total

Total

Total

Days

Cost

Days

Cost

Miles

Cost

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

TOTAL

NOTICE

Section 1924, Title 28, U.S. Code (effective September 1, 1948) provides:

“Sec. 1924. Verification of bill of costs.”

“Before any bill of costs is taxed, the party claiming any item of cost or disbursement shall attach thereto an affidavit, made by himself or by

his duly authorized attorney or agent having knowledge of the facts, that such item is correct and has been necessarily incurred in the case and

that the services for which fees have been charged were actually and necessarily performed.”

See also Section 1920 of Title 28, which reads in part as follows:

“A bill of costs shall be filed in the case and, upon allowance, included in the judgment or decree.”

The Federal Rules of Civil Procedure contain the following provisions:

RULE 54(d)(1)

Costs Other than Attorneys’ Fees.

Unless a federal statute, these rules, or a court order provides otherwise, costs — other than attorney's fees — should be allowed to the

prevailing party. But costs against the United States, its officers, and its agencies may be imposed only to the extent allowed by law. The clerk

may tax costs on 14 day's notice. On motion served within the next 7 days, the court may review the clerk's action.

RULE 6

(d) Additional Time After Certain Kinds of Service.

When a party may or must act within a specified time after service and service is made under Rule5(b)(2)(C), (D), (E), or (F), 3 days are

added after the period would otherwise expire under Rule 6(a).

RULE 58(e)

Cost or Fee Awards:

Ordinarily, the entry of judgment may not be delayed, nor the time for appeal extended, in order to tax costs or award fees. But if a

timely motion for attorney's fees is made under Rule 54(d)(2), the court may act before a notice of appeal has been filed and become

effective to order that the motion have the same effect under Federal Rule of Appellate Procedure 4(a)(4) as a timely motion under Rule 59.

Print

Save As...

Reset

1

1 2

2