Form Cert-135 - Reduced Sales And Use Tax Rate For Motor Vehicles Purchased By Nonresident Military Personnel And Their Spouses

ADVERTISEMENT

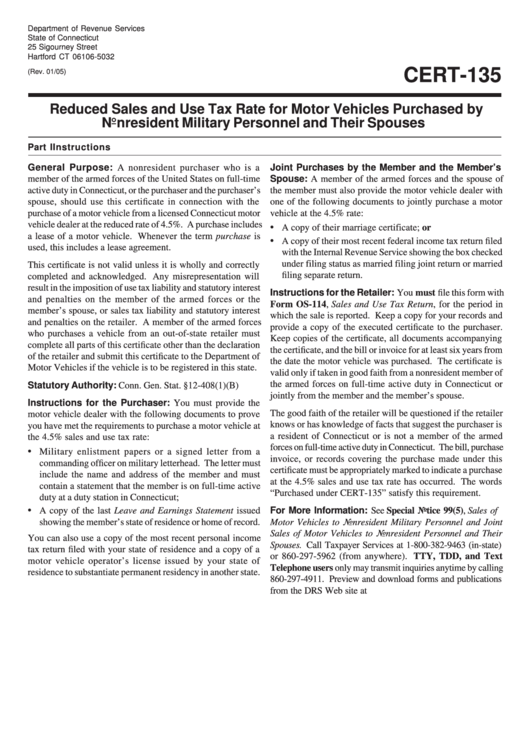

Department of Revenue Services

State of Connecticut

25 Sigourney Street

Hartford CT 06106-5032

CERT-135

(Rev. 01/05)

Reduced Sales and Use Tax Rate for Motor Vehicles Purchased by

Nonresident Military Personnel and Their Spouses

Part I Instructions

General Purpose: A nonresident purchaser who is a

Joint Purchases by the Member and the Member’s

Spouse: A member of the armed forces and the spouse of

member of the armed forces of the United States on full-time

active duty in Connecticut, or the purchaser and the purchaser’s

the member must also provide the motor vehicle dealer with

spouse, should use this certificate in connection with the

one of the following documents to jointly purchase a motor

purchase of a motor vehicle from a licensed Connecticut motor

vehicle at the 4.5% rate:

vehicle dealer at the reduced rate of 4.5%. A purchase includes

•

A copy of their marriage certificate; or

a lease of a motor vehicle. Whenever the term purchase is

•

A copy of their most recent federal income tax return filed

used, this includes a lease agreement.

with the Internal Revenue Service showing the box checked

under filing status as married filing joint return or married

This certificate is not valid unless it is wholly and correctly

filing separate return.

completed and acknowledged. Any misrepresentation will

result in the imposition of use tax liability and statutory interest

Instructions for the Retailer: You must file this form with

and penalties on the member of the armed forces or the

Form OS-114, Sales and Use Tax Return, for the period in

member’s spouse, or sales tax liability and statutory interest

which the sale is reported. Keep a copy for your records and

and penalties on the retailer. A member of the armed forces

provide a copy of the executed certificate to the purchaser.

who purchases a vehicle from an out-of-state retailer must

Keep copies of the certificate, all documents accompanying

complete all parts of this certificate other than the declaration

the certificate, and the bill or invoice for at least six years from

of the retailer and submit this certificate to the Department of

the date the motor vehicle was purchased. The certificate is

Motor Vehicles if the vehicle is to be registered in this state.

valid only if taken in good faith from a nonresident member of

the armed forces on full-time active duty in Connecticut or

Statutory Authority: Conn. Gen. Stat. §12-408(1)(B)

jointly from the member and the member’s spouse.

Instructions for the Purchaser: You must provide the

The good faith of the retailer will be questioned if the retailer

motor vehicle dealer with the following documents to prove

knows or has knowledge of facts that suggest the purchaser is

you have met the requirements to purchase a motor vehicle at

a resident of Connecticut or is not a member of the armed

the 4.5% sales and use tax rate:

forces on full-time active duty in Connecticut. The bill, purchase

•

Military enlistment papers or a signed letter from a

invoice, or records covering the purchase made under this

commanding officer on military letterhead. The letter must

certificate must be appropriately marked to indicate a purchase

include the name and address of the member and must

at the 4.5% sales and use tax rate has occurred. The words

contain a statement that the member is on full-time active

“Purchased under CERT-135” satisfy this requirement.

duty at a duty station in Connecticut;

•

A copy of the last Leave and Earnings Statement issued

For More Information: See Special Notice 99(5), Sales of

showing the member’s state of residence or home of record.

Motor Vehicles to Nonresident Military Personnel and Joint

Sales of Motor Vehicles to Nonresident Personnel and Their

You can also use a copy of the most recent personal income

Spouses. Call Taxpayer Services at 1-800-382-9463 (in-state)

tax return filed with your state of residence and a copy of a

or 860-297-5962 (from anywhere). TTY, TDD, and Text

motor vehicle operator’s license issued by your state of

Telephone users only may transmit inquiries anytime by calling

residence to substantiate permanent residency in another state.

860-297-4911. Preview and download forms and publications

from the DRS Web site at

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2