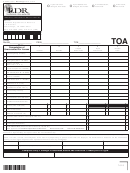

Michigan Department of Treasury

Terminal Operator Annual Return

412166642

E38MI990200

Name: ANDERSONS ALBION ETHANOL LLC

FEIN/SSN:

License:

Jurisdiction:

Tax Type:

Return Type:

Return Seq:

Access Mode

MI

TA

Original

1

Update

Transmission Status:

Not Requested

Return Period:

12/2008

Postmark Date:

01/08/2009

Column A

Column B

Column C

Column D

Column E

Column F

PART 2: TAX CALCULATIONS

Gasoline Products

Ethanol

Aviation Gas

Jet Fuel

Diesel Products

Undyed Biodiesel

(Incl.

E70 - E99

(Undyed )

(B05 or higher)

REPORT NET GALLONS

Transmix)

15. Actual physical ending inventory (December 31 of reporting

0

0

0

0

0

0

period).

16. Beginning actual physical inventory (January 1 of reporting

0

0

0

0

0

period).

17. Receipts during reporting period.

0

0

0

0

0

0

18. Total gallons available. Add lines 16 and 17.

0

0

0

0

0

0

19. Fuel removed from the terminal across the rack during the

0

0

0

0

0

0

reporting period.

20. Fuel removed from the terminal in bulk (i.e. pipeline, marine, etc)

0

0

0

0

0

0

during the reporting period (include mode of transport ST and BA).

21. Total disbursements during the reporting period. Add lines 19 and

0

0

0

0

0

0

20.

22. Computed ending inventory. Subtract line 21 from line 18.

0

0

0

0

0

0

23. Net loss or unaccounted for gallons. If line 22 is greater than line

0

0

0

0

0

0

15, subtract line 15 from line 22. If line 15 is greater than line 22,

24. Allowable loss. Multiply line 21 by .005 (1/2 of 1% of all net

0

0

0

0

0

0

gallons of fuel removed).

0

0

0

0

0

0

25. Taxable loss. If line 23 is greater than line 24, subtract line 24 from

23. If line 24 is greater than line 23, enter zero(0).

26. TAX RATE.

0.19

0.19

0.19

0.15

0.15

0.15

0.19

0.19

0.19

0.15

0.15

0.15

27. TAX DUE. Multiply line 25 by line 26 for each column. Enter here

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

and the total of columns A, B, C, D, E, and F on line 10, page 1.

28D

28A

28B

28C

28. Add columns A and B from line 27 and enter total in 28A. Carry

$0.00

$0.00

$0.00

$0.00

column C total from line 27 to 28B. Carry column D total from line 27

Page 2 of 3

Thursday, January 8 2009

1

1 2

2 3

3 4

4