Form Au-798 - Dissolution Guarantee Declaration For Non-Stock Corporations

ADVERTISEMENT

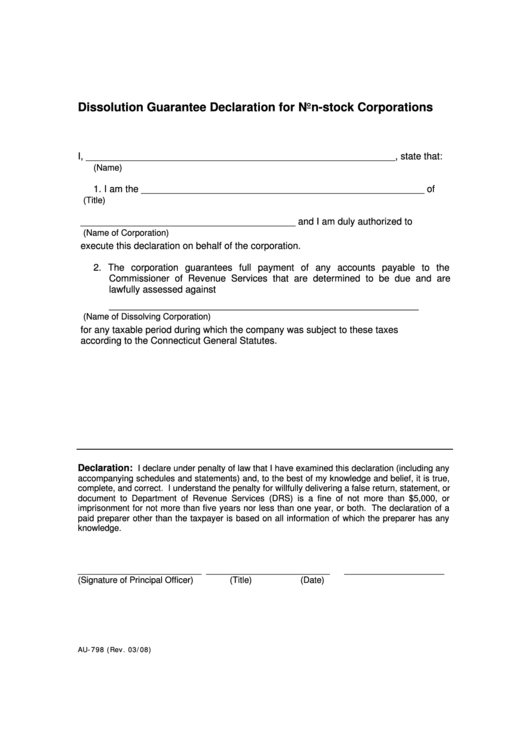

Dissolution Guarantee Declaration for Non-stock Corporations

I, ___________________________________________________________, state that:

(Name)

1. I am the ______________________________________________________ of

(Title)

_________________________________________ and I am duly authorized to

(Name of Corporation)

execute this declaration on behalf of the corporation.

2. The corporation guarantees full payment of any accounts payable to the

Commissioner of Revenue Services that are determined to be due and are

lawfully assessed against

___________________________________________________________

(Name of Dissolving Corporation)

for any taxable period during which the company was subject to these taxes

according to the Connecticut General Statutes.

Declaration:

I declare under penalty of law that I have examined this declaration (including any

accompanying schedules and statements) and, to the best of my knowledge and belief, it is true,

complete, and correct. I understand the penalty for willfully delivering a false return, statement, or

document to Department of Revenue Services (DRS) is a fine of not more than $5,000, or

imprisonment for not more than five years nor less than one year, or both. The declaration of a

paid preparer other than the taxpayer is based on all information of which the preparer has any

knowledge.

__________________________ __________________________

_____________________

(Signature of Principal Officer)

(Title)

(Date)

AU-798 (Rev. 03/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1