Instructions For Form 41 - Oregon Fiduciary Income Tax - 2014 Page 8

ADVERTISEMENT

1

1

2

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

8

8

2

8

8

8

1

2

3

5

6 7 8 9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

3

4

5

4

Clear Form

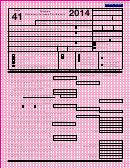

82

3

3

2014

For office use only

4

4

Oregon

Form

41

Date received

5

5

•

Fiduciary Income Tax Return

6

6

Payment

7

7

•

8

8

Penalty date

(101, 102)

or Fiscal year

Month Day

Year

Month Day

Year

9

9

•

•

beginning:

Ending:

XX/XX/XXXX

XX/XX/XXXX

10

10

Name of trust or estate (first name, middle initial, last name)—print clearly or type

1

2

3

X

Check if new name

11

11

•

•

•

XXXXXXXXXXXX X XXXXXXXXXXXXXXXXXXXX

12

12

Name of fiduciary (first name, last name)

Oregon business identification number (BIN)

X

Check if new name

13

13

•

XXXXXXXX-X

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

14

14

Title (TTEE or PR)

Federal employer identification number (FEIN)

15

15

X

Check if new FEIN

XX-XXXXXXX

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

16

16

Street address or PO Box

X

Check if new address

X

Extension to file

17

17

XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

X

Form 24 is attached

18

18

City

State

ZIP code

X

Amended return

19

19

XXXXXXXXXXXXXXXXXXXXX

XXX

XXXXX-XXXX

20

20

•

A. Check only one box:

B. This is:

C. Check one box:

D. If exempt organization,

21

21

An estate—date of death: _________________.

A first return.

An Oregon resident.

check federal form filed:

X

X

X

XX/XX/XXXX

(101)

22

22

A bankruptcy estate.

A final return.

A nonresident.

990-T—Specify

X

X

X

X

(102)

23

23

your due date:

A part-year trust

X

A funeral trust.

X

24

(102)

24

(use Schedule P to

_________________.

XX/XX/XXXX

A trust.

X

(102)

25

25

compute the tax).

Other—Specify:

X

A trust filing as an estate. Attach IRS Form 8855.

X

(101)

26

26

_________________.

XX/XX/XXXX

Date of death: _________________.

XX/XX/XXXX

27

27

Attach a copy of federal Form 1041, Schedule K-1s, applicable schedules, 1099, W-2, OR-18, OR-19

28

28

Round all amounts to the nearest whole dollar

29

29

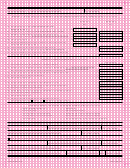

1. Revised distributable net income from

Beneficiary column

Fiduciary column

30

30

XXXXXXXXXXXXXXX

Form 41, Schedule 1, line 27 ........................... 1

31

31

2. Distribution deduction from federal Form 1041, Schedule B, line 15,

32

32

XXXXXXXXXXXXXXX

plus Form 41, Schedule 1, line 29 ............................................................... 2

33

33

a. Tax-exempt income deducted in computing

34

34

distribution deduction from federal

35

35

Form 1041, Schedule B, line 12 ................. 2a

XXXXXXXXXXXXXXX

36

36

b. Add lines 2 and 2a ....................................... 2b

XXXXXXXXXXXXXXX

37

37

XXXXXXXXXXXXXXX

XXXXXXXXXX

3. Percentage = Line 2b $

= 3

%

38

38

XXXXXXXXXXXXXXX

Line 1

$

39

39

XXXXXXXXXXXXXXX

4. Revised taxable income of fiduciary from Form 41, Schedule 1, line 30 ............................................... 4

40

40

5. Fiduciary adjustment from Form 41, Schedule 2, line 42

41

41

X

X

XXXXXXXXXXXXXXX

Show as an

addition or

subtraction ............ 5

42

42

XXXXXXXXXXXXXXX

a. Beneficiary’s share (line 5 × % on line 3—see instructions) ................... 5a

43

43

XXXXXXXXXXXXXXX

b. Fiduciary’s share (line 5 minus line 5a) .............................................................................................. 5b

44

44

6. Income to be reported by beneficiaries (Form 1041, Schedule K-1

45

45

XXXXXXXXXXXXXXX

attached—see instructions) (line 2 plus line 5a) ........................................... 6

46

46

XXXXXXXXXXXXXXX

7. Oregon taxable income of fiduciary (total or net of lines 4 and 5b) .......................................................... 7

47

47

XXXXXXXXXXXXXXX

8. Tax using rate schedule on page 2, or from Schedule P, line 11 ....................................................... 8

48

48

XXXXXXXXXXXXXXX

XXXXXXXXXXXXXXX

9. NLTCG from Schedule 1, line 25, column B: 9a

× 0.05 ............................. 9b

49

49

XXXXXXXXXXXXXXX

10. Total tax (add lines 8 and 9b) .................................................................................................................. 10

50

50

XXXXXXXXXXXXXXX

11. Tax credits. (Enter payments on line 14.) (See instructions.) Identify credit_____________________ .... 11

51

51

•

XXXXXXXXXXXXXXX

12. Balance of tax (line 10 minus line 11; if line 11 is more than line 10, enter -0-) ..................................

12

52

52

13. Oregon income tax withheld (attach Form 1099,

53

53

•

XXXXXXXXXXXXXXX

W-2, OR-18, OR-19 above) ............................

13

54

54

XXXXXXXXXXXXXXX

14. Payments and claim of right credit (see instr.) ... 14

55

55

XXXXXXXXXXXXXXX

15. Total payments (line 13 plus line 14) ....................................................................................................... 15

56

56

XXXXXXXXXXXXXXX

16. Tax due. Is line 12 more than line 15? If so, line 12 minus line 15 ........................................... Tax due 16

57

57

XXXXXXXXXXXXXXX

17. Overpayment. Is line 15 more than line 12? If so, line 15 minus line 12 ....................... Overpayment 17

58

58

XXXXXXXXXXXXXXX

18. Penalty for filing or paying late (see instructions) ................................................................................... 18

59

59

XXXXXXXXXXXXXXX

19. Interest due with this return (see instructions) ........................................................................................ 19

60

60

XXXXXXXXXXXXXXX

20. Total due (line 16 plus lines 18 and 19) ..................................................................................Total due 20

61

61

XXXXXXXXXXXXXXX

21. Refund (line 17 minus lines 18 and 19) (see instructions) ......................................................... Refund 21

62

62

63

63

150-101-041 (Rev. 10-14)

Form 41, page 1 of 2

64

64

65

65

8

8

8

1

1

1

1

1

1

1

1

1

1

2

2

2

2

2

2

2

2

2

2

3

3

3

3

3

3

3

3

3

3

4

4

4

4

4

4

4

4

4

4

5

5

5

5

5

5

5

5

5

5

6

6

6

6

6

6

6

6

6

6

7

7

7

7

7

7

7

7

7

7

8

8

1

2

3

5

6 7 8 9

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

2

3

4

5

6

7

8

9

0

1

3

4

5

0

4

82

66

66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9