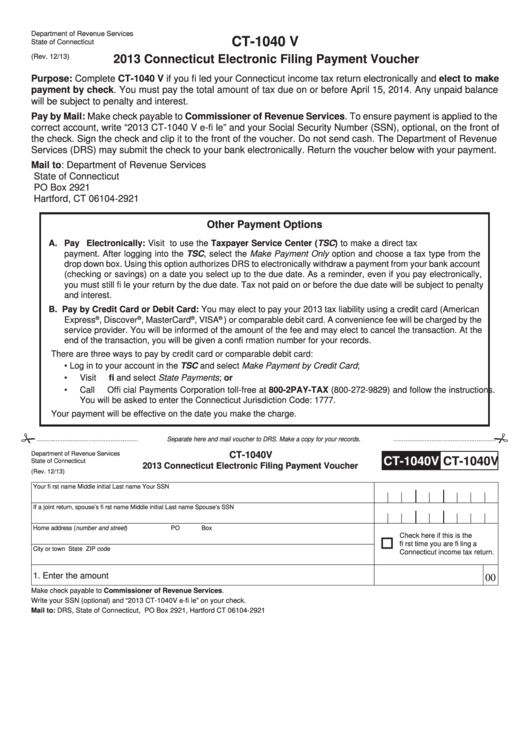

Form Ct-1040 V - Connecticut Electronic Filing Payment Voucher - 2013

ADVERTISEMENT

Department of Revenue Services

CT-1040 V

State of Connecticut

(Rev. 12/13)

2013 Connecticut Electronic Filing Payment Voucher

Purpose: Complete CT-1040 V if you fi led your Connecticut income tax return electronically and elect to make

payment by check. You must pay the total amount of tax due on or before April 15, 2014. Any unpaid balance

will be subject to penalty and interest.

Pay by Mail: Make check payable to Commissioner of Revenue Services. To ensure payment is applied to the

correct account, write “2013 CT-1040 V e-fi le” and your Social Security Number (SSN), optional, on the front of

the check. Sign the check and clip it to the front of the voucher. Do not send cash. The Department of Revenue

Services (DRS) may submit the check to your bank electronically. Return the voucher below with your payment.

Mail to:

Department of Revenue Services

State of Connecticut

PO Box 2921

Hartford, CT 06104-2921

Other Payment Options

A. Pay Electronically: Visit to use the Taxpayer Service Center (TSC) to make a direct tax

payment. After logging into the TSC, select the Make Payment Only option and choose a tax type from the

drop down box. Using this option authorizes DRS to electronically withdraw a payment from your bank account

(checking or savings) on a date you select up to the due date. As a reminder, even if you pay electronically,

you must still fi le your return by the due date. Tax not paid on or before the due date will be subject to penalty

and interest.

B. Pay by Credit Card or Debit Card: You may elect to pay your 2013 tax liability using a credit card (American

®

®

®

®

Express

, Discover

, MasterCard

, VISA

) or comparable debit card. A convenience fee will be charged by the

service provider. You will be informed of the amount of the fee and may elect to cancel the transaction. At the

end of the transaction, you will be given a confi rmation number for your records.

There are three ways to pay by credit card or comparable debit card:

•

Log in to your account in the TSC and select Make Payment by Credit Card;

•

Visit and select State Payments; or

•

Call Offi cial Payments Corporation toll-free at 800-2PAY-TAX (800-272-9829) and follow the instructions.

You will be asked to enter the Connecticut Jurisdiction Code: 1777.

Your payment will be effective on the date you make the charge.

Separate here and mail voucher to DRS. Make a copy for your records.

Department of Revenue Services

CT-1040V

CT-1040V

CT-1040V

State of Connecticut

2013 Connecticut Electronic Filing Payment Voucher

(Rev. 12/13)

Your fi rst name

Middle initial

Last name

Your SSN

If a joint return, spouse’s fi rst name

Middle initial

Last name

Spouse’s SSN

Home address (number and street)

PO Box

Check here if this is the

fi rst time you are fi ling a

City or town

State

ZIP code

Connecticut income tax return.

1. Enter the amount enclosed.......................................................................................... 1.

00

Make check payable to Commissioner of Revenue Services.

Write your SSN (optional) and “2013 CT-1040V e-fi le” on your check.

Mail to: DRS, State of Connecticut, PO Box 2921, Hartford CT 06104-2921

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1