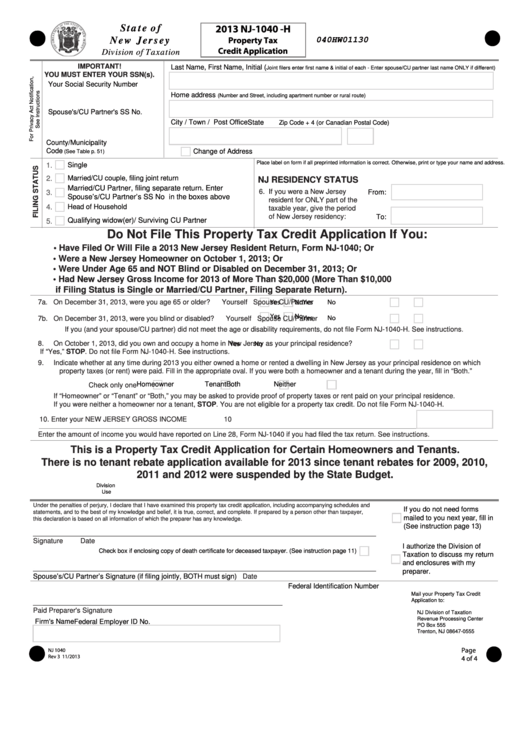

State of

2013 NJ-1040 -H

New Jersey

Property Tax

040HW01130

Credit Application

Division of Taxation

IMPORTANT!

Last Name, First Name, Initial (

Joint filers enter first name & initial of each - Enter spouse/CU partner last name ONLY if different)

YOU MUST ENTER YOUR SSN(s).

Your Social Security Number

Home address

(Number and Street, including apartment number or rural route)

Spouse's/CU Partner's SS No.

City / Town / Post Office

State

Zip Code + 4 (or Canadian Postal Code)

County/Municipality

Code

Change of Address

(See Table p. 51)

Place label on form if all preprinted information is correct. Otherwise, print or type your name and address.

1.

Single

2.

Married/CU couple, filing joint return

NJ RESIDENCY STATUS

Married/CU Partner, filing separate return. Enter

6. If you were a New Jersey

3.

From:

Spouse’s/CU Partner’s SS No in the boxes above

resident for ONLY part of the

4.

Head of Household

taxable year, give the period

of New Jersey residency:

To:

Qualifying widow(er)/ Surviving CU Partner

5.

Do Not File This Property Tax Credit Application If You:

• Have Filed Or Will File a 2013 New Jersey Resident Return, Form NJ-1040; Or

• Were a New Jersey Homeowner on October 1, 2013; Or

• Were Under Age 65 and NOT Blind or Disabled on December 31, 2013; Or

• Had New Jersey Gross Income for 2013 of More Than $20,000 (More Than $10,000

if Filing Status is Single or Married/CU Partner, Filing Separate Return).

Yes

No

Yes

No

7a. On December 31, 2013, were you age 65 or older?

Yourself

Spouse CU/Partner

Yes

No

Yes

No

7b. On December 31, 2013, were you blind or disabled?

Yourself

Spouse CU/Partner

If you (and your spouse/CU partner) did not meet the age or disability requirements, do not file Form NJ-1040-H. See instructions.

Yes

No

8.

On October 1, 2013, did you own and occupy a home in New Jersey as your principal residence?

If “Yes,” STOP. Do not file Form NJ-1040-H. See instructions.

9.

Indicate whether at any time during 2013 you either owned a home or rented a dwelling in New Jersey as your principal residence on which

property taxes (or rent) were paid. Fill in the appropriate oval. If you were both a homeowner and a tenant during the year, fill in “Both.”

Homeowner

Tenant

Both

Neither

Check only one

If “Homeowner” or “Tenant” or “Both,” you may be asked to provide proof of property taxes or rent paid on your principal residence.

If you were neither a homeowner nor a tenant, STOP. You are not eligible for a property tax credit. Do not file Form NJ-1040-H.

10. Enter your NEW JERSEY GROSS INCOME

10

Enter the amount of income you would have reported on Line 28, Form NJ-1040 if you had filed the tax return. See instructions.

This is a Property Tax Credit Application for Certain Homeowners and Tenants.

There is no tenant rebate application available for 2013 since tenant rebates for 2009, 2010,

2011 and 2012 were suspended by the State Budget.

Division

Use

Under the penalties of perjury, I declare that I have examined this property tax credit application, including accompanying schedules and

If you do not need forms

statements, and to the best of my knowledge and belief, it is true, correct, and complete. If prepared by a person other than taxpayer,

mailed to you next year, fill in

this declaration is based on all information of which the preparer has any knowledge.

(See instruction page 13)

Signature

Date

I authorize the Division of

Check box if enclosing copy of death certificate for deceased taxpayer. (See instruction page 11)

Taxation to discuss my return

and enclosures with my

preparer.

Spouse’s/CU Partner’s Signature (if filing jointly, BOTH must sign)

Date

Federal Identification Number

Mail your Property Tax Credit

Application to:

Paid Preparer's Signature

NJ Division of Taxation

Revenue Processing Center

Firm's Name

Federal Employer ID No.

PO Box 555

Trenton, NJ 08647-0555

Page

NJ 1040

Rev 3 11/2013

4 of 4

1

1