Form 207 - Underpayment Of Estimated Insurance Premiums Tax Or Health Care Center Tax - 2014

ADVERTISEMENT

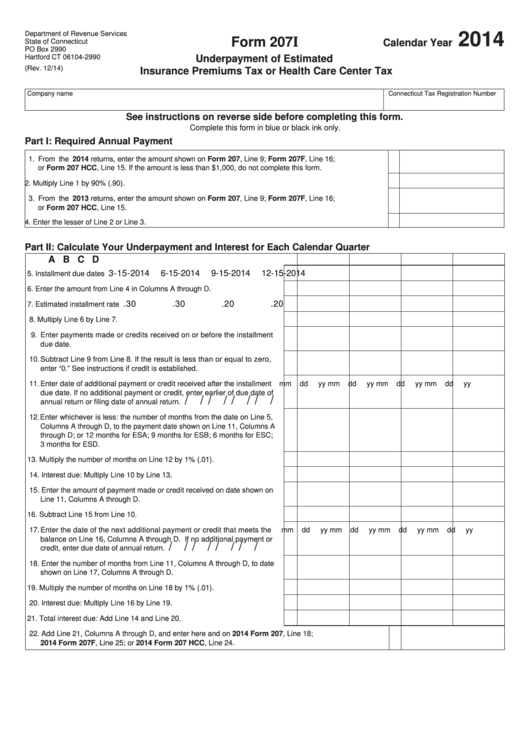

Department of Revenue Services

2014

Form 207

I

Calendar Year

State of Connecticut

PO Box 2990

Hartford CT 06104-2990

Underpayment of Estimated

(Rev. 12/14)

Insurance Premiums Tax or Health Care Center Tax

Company name

Connecticut Tax Registration Number

See instructions on reverse side before completing this form.

Complete this form in blue or black ink only.

Part I: Required Annual Payment

1. From the 2014 returns, enter the amount shown on Form 207, Line 9; Form 207F, Line 16;

or Form 207 HCC, Line 15. If the amount is less than $1,000, do not complete this form. ...........................

1

2. Multiply Line 1 by 90% (.90). ...........................................................................................................................

2

3. From the 2013 returns, enter the amount shown on Form 207, Line 9; Form 207F, Line 16;

or Form 207 HCC, Line 15. ............................................................................................................................

3

4. Enter the lesser of Line 2 or Line 3. ................................................................................................................

4

Part II: Calculate Your Underpayment and Interest for Each Calendar Quarter

A

B

C

D

3-15-2014

6-15-2014

9-15-2014 12-15-2014

5. Installment due dates ..................................................................................

5

6. Enter the amount from Line 4 in Columns A through D. .............................

6

.30

.30

.20

.20

7. Estimated installment rate ...........................................................................

7

8. Multiply Line 6 by Line 7. ............................................................................

8

9. Enter payments made or credits received on or before the installment

due date. .....................................................................................................

9

10. Subtract Line 9 from Line 8. If the result is less than or equal to zero,

enter “0.” See instructions if credit is established. ...................................... 10

11. Enter date of additional payment or credit received after the installment

mm

dd

yy mm

dd

yy mm

dd

yy mm

dd

yy

due date. If no additional payment or credit, enter earlier of due date of

/ /

/ /

/ /

/ /

annual return or fi ling date of annual return. ...............................................

11

12. Enter whichever is less: the number of months from the date on Line 5,

Columns A through D, to the payment date shown on Line 11, Columns A

through D; or 12 months for ESA; 9 months for ESB; 6 months for ESC;

3 months for ESD. ....................................................................................... 12

13. Multiply the number of months on Line 12 by 1% (.01). ............................. 13

14. Interest due: Multiply Line 10 by Line 13. ................................................... 14

15. Enter the amount of payment made or credit received on date shown on

Line 11, Columns A through D. ................................................................... 15

16. Subtract Line 15 from Line 10. .................................................................... 16

17. Enter the date of the next additional payment or credit that meets the

mm

dd

yy mm

dd

yy mm

dd

yy mm

dd

yy

balance on Line 16, Columns A through D. If no additional payment or

/ /

/ /

/ /

/ /

credit, enter due date of annual return. ....................................................... 17

18. Enter the number of months from Line 11, Columns A through D, to date

shown on Line 17, Columns A through D. ................................................... 18

19. Multiply the number of months on Line 18 by 1% (.01). ............................. 19

20. Interest due: Multiply Line 16 by Line 19. ................................................... 20

21. Total interest due: Add Line 14 and Line 20. .............................................. 21

22. Add Line 21, Columns A through D, and enter here and on 2014 Form 207, Line 18;

2014 Form 207F, Line 25; or 2014 Form 207 HCC, Line 24. ......................................................................... 22

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2