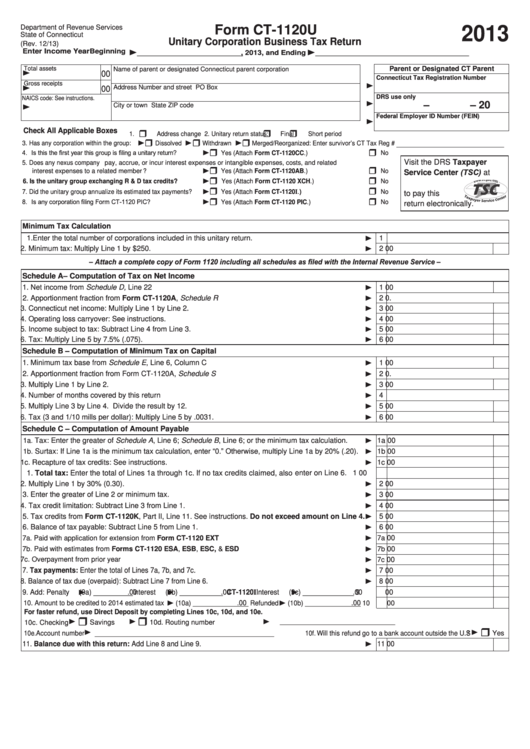

Form Ct-1120u - Unitary Corporation Business Tax Return - 2013

ADVERTISEMENT

Department of Revenue Services

Form CT-1120U

2013

State of Connecticut

Unitary Corporation Business Tax Return

(Rev. 12/13)

Enter Income Year Beginning ____________________, 2013, and Ending _____________________________________

Total assets

Parent or Designated CT Parent

Name of parent or designated Connecticut parent corporation

00

Connecticut Tax Registration Number

Gross receipts

Address

Number and street

PO Box

00

DRS use only

NAICS code: See instructions.

–

– 20

City or town

State

ZIP code

Federal Employer ID Number (FEIN)

Check All Applicable Boxes

1.

Address change 2. Unitary return status:

Final

Short period

3. Has any corporation within the group:

Dissolved

Withdrawn

Merged/Reorganized: Enter survivor’s CT Tax Reg # _______________________________

4. Is this the first year this group is filing a unitary return?

Yes (Attach Form CT-1120CC.)

No

Visit the DRS Taxpayer

5. Does any nexus company pay, accrue, or incur interest expenses or intangible expenses, costs, and related

Service Center (TSC) at

interest expenses to a related member?

Yes (Attach Form CT-1120AB.)

No

6. Is the unitary group exchanging R & D tax credits?

Yes (Attach Form CT-1120 XCH.)

No

7. Did the unitary group annualize its estimated tax payments?

Yes (Attach Form CT-1120I.)

No

to pay this

8. Is any corporation filing Form CT-1120 PIC?

Yes (Attach Form CT-1120 PIC.)

No

return electronically.

Minimum Tax Calculation

1. Enter the total number of corporations included in this unitary return. .................................................

1

2. Minimum tax: Multiply Line 1 by $250. ..................................................................................................

2

00

– Attach a complete copy of Form 1120 including all schedules as filed with the Internal Revenue Service –

Schedule A – Computation of Tax on Net Income

1. Net income from Schedule D, Line 22 ..................................................................................................

1

00

2. Apportionment fraction from Form CT-1120A, Schedule R .................................................................

2

0.

3. Connecticut net income: Multiply Line 1 by Line 2. ...............................................................................

3

00

4. Operating loss carryover: See instructions. ..........................................................................................

4

00

5. Income subject to tax: Subtract Line 4 from Line 3. ..............................................................................

5

00

6. Tax: Multiply Line 5 by 7.5% (.075). ......................................................................................................

6

00

Schedule B – Computation of Minimum Tax on Capital

1. Minimum tax base from Schedule E, Line 6, Column C .......................................................................

1

00

2. Apportionment fraction from Form CT-1120A, Schedule S ..................................................................

2

0.

3. Multiply Line 1 by Line 2. ......................................................................................................................

3

00

4. Number of months covered by this return .............................................................................................

4

5. Multiply Line 3 by Line 4. Divide the result by 12. ................................................................................

5

00

6. Tax (3 and 1/10 mills per dollar): Multiply Line 5 by .0031. ..................................................................

6

00

Schedule C – Computation of Amount Payable

1a.

Tax: Enter the greater of Schedule A, Line 6; Schedule B, Line 6; or the minimum tax calculation. ....

1a

00

Surtax: If Line 1a is the minimum tax calculation, enter “0.” Otherwise, multiply Line 1a by 20% (.20).

1b

00

1b.

1c. Recapture of tax credits: See instructions. ...........................................................................................

1c

00

1. Total tax: Enter the total of Lines 1a through 1c. If no tax credits claimed, also enter on Line 6. ......

1

00

2. Multiply Line 1 by 30% (0.30). ...............................................................................................................

2

00

3. Enter the greater of Line 2 or minimum tax. ..........................................................................................

3

00

4. Tax credit limitation: Subtract Line 3 from Line 1. .................................................................................

4

00

5. Tax credits from Form CT-1120K, Part II, Line 11. See instructions. Do not exceed amount on Line 4.

5

00

6. Balance of tax payable: Subtract Line 5 from Line 1.

6

00

.................................................................................

7a. Paid with application for extension from Form CT-1120 EXT .........................................................................

7a

00

00

7b. Paid with estimates from Forms CT-1120 ESA, ESB, ESC, & ESD ..............................................................

7b

00

7c. Overpayment from prior year ..........................................................................................................................

7c

7. Tax payments: Enter the total of Lines 7a, 7b, and 7c. ...................................................................................

7

00

8. Balance of tax due (overpaid): Subtract Line 7 from Line 6. .........................................................................

8

00

9. Add: Penalty

(9a) __________ Interest

.00

(9b) ___________ CT-1120I Interest

.00

(9c) _____________

.00

9

00

10. Amount to be credited to 2014 estimated tax

(10a) _______________ Refunded

.00

(10b) _______________

.00

10

00

For faster refund, use Direct Deposit by completing Lines 10c, 10d, and 10e.

__________________________

10c. Checking

Savings

10d. Routing number

10e. Account number

______________________________________________

10f. Will this refund go to a bank account outside the U.S.?

Yes

11. Balance due with this return: Add Line 8 and Line 9. ..............................................................................

11

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3