20898

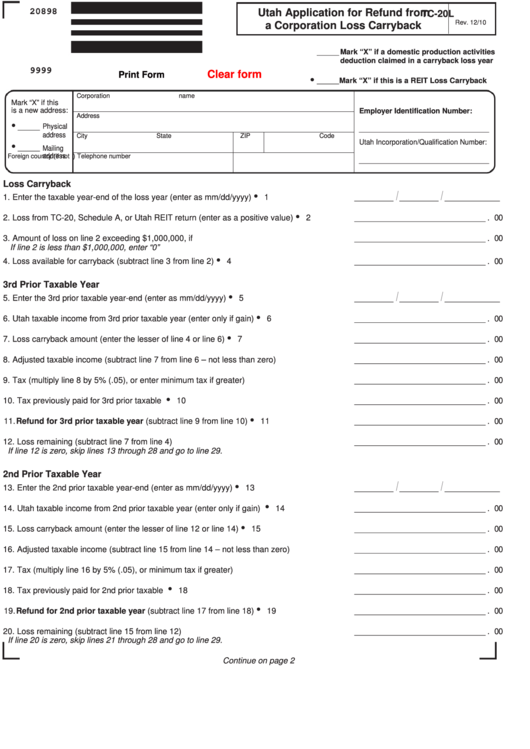

Utah Application for Refund from

TC-20L

Rev. 12/10

a Corporation Loss Carryback

_ _ _ Mark “X” if a domestic production activities

deduction claimed in a carryback loss year

9999

Clear form

Print Form

•

_ _ _ Mark “X” if this is a REIT Loss Carryback

Corporation name

Mark “X” if this

is a new address:

Employer Identification Number:

Address

•

_ __ Physical

_ _ _ _ _ _ _ _ _ _ _ _ ______ _

address

City

State

ZIP Code

Utah Incorporation/Qualification Number:

•

_ __ Mailing

address

Foreign country (if not U.S.)

Telephone number

_ _ _ _ _ _ _ _ _ _ _ _ ______ _

Loss Carryback

•

/

/

1. Enter the taxable year-end of the loss year (enter as mm/dd/yyyy)............................

1 _____

_____

__ _ __ _ _

•

2. Loss from TC-20, Schedule A, or Utah REIT return (enter as a positive value) .........

2 _____ ______ __ __ _ _ . 00

3. Amount of loss on line 2 exceeding $1,000,000, if any...............................................

3 ___ _____ ____ __ _ __ . 00

If line 2 is less than $1,000,000, enter “0”

•

4. Loss available for carryback (subtract line 3 from line 2) ............................................

4 __ _____ ______ _ __ _ . 00

3rd Prior Taxable Year

•

/

/

5. Enter the 3rd prior taxable year-end (enter as mm/dd/yyyy).......................................

5 _____

_____

__ _ __ _ _

•

6. Utah taxable income from 3rd prior taxable year (enter only if gain) ..........................

6 __ _____ ______ _ __ _ . 00

•

7. Loss carryback amount (enter the lesser of line 4 or line 6) .......................................

7 __ _____ ______ _ __ _ . 00

8. Adjusted taxable income (subtract line 7 from line 6 – not less than zero) .................

8 __ _____ ______ _ __ _ . 00

9. Tax (multiply line 8 by 5% (.05), or enter minimum tax if greater) ...............................

9 __ _____ ______ _ __ _ . 00

•

10. Tax previously paid for 3rd prior taxable year..............................................................

10 _____ _____ __ __ _ __ . 00

•

11. Refund for 3rd prior taxable year (subtract line 9 from line 10)...............................

11 __ _____ ______ _ __ _ . 00

12. Loss remaining (subtract line 7 from line 4) ................................................................

12 _ _____ _____ ___ _ __ . 00

If line 12 is zero, skip lines 13 through 28 and go to line 29.

2nd Prior Taxable Year

•

/

/

13. Enter the 2nd prior taxable year-end (enter as mm/dd/yyyy)......................................

13 _____

_____

_ __ __ _ _

•

14. Utah taxable income from 2nd prior taxable year (enter only if gain) .........................

14 __ _____ ______ _ __ _ . 00

•

15. Loss carryback amount (enter the lesser of line 12 or line 14) ...................................

15 _ _____ _____ ___ _ __ . 00

16. Adjusted taxable income (subtract line 15 from line 14 – not less than zero) .............

16 __ _____ ______ _ __ _ . 00

17. Tax (multiply line 16 by 5% (.05), or minimum tax if greater) ......................................

17 __ _____ ______ _ __ _ . 00

•

18. Tax previously paid for 2nd prior taxable year.............................................................

18 _____ ______ ___ _ __ . 00

•

19. Refund for 2nd prior taxable year (subtract line 17 from line 18) ............................

19 __ _____ ______ _ __ _ . 00

20. Loss remaining (subtract line 15 from line 12) ............................................................

20 _ _____ _____ ___ _ __ . 00

If line 20 is zero, skip lines 21 through 28 and go to line 29.

Continue on page 2

1

1 2

2 3

3 4

4