Form Ct-1120 - Computation Of Interest Due On Underpayment Of Estimated Tax - 2013

ADVERTISEMENT

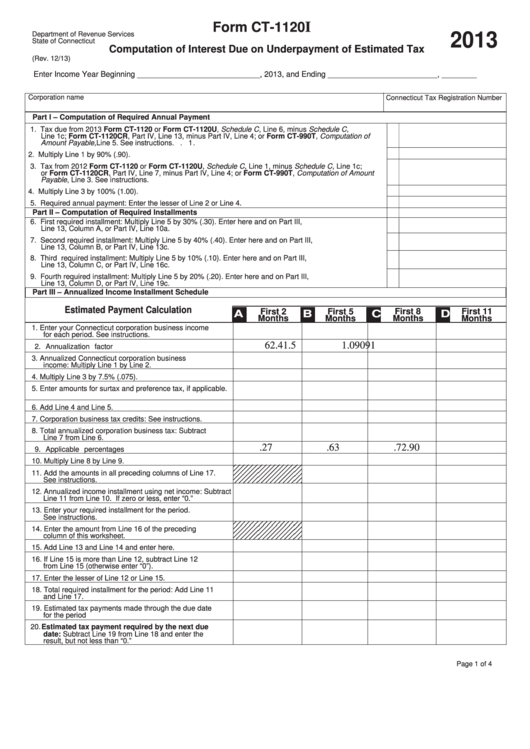

Form CT-1120

I

Department of Revenue Services

2013

State of Connecticut

Computation of Interest Due on Underpayment of Estimated Tax

(Rev. 12/13)

Enter Income Year Beginning ____________________________ , 2013, and Ending _________________________ , ________

Corporation name

Connecticut Tax Registration Number

Part I – Computation of Required Annual Payment

1. Tax due from 2013 Form CT-1120 or Form CT-1120U, Schedule C, Line 6, minus Schedule C,

Line 1c; Form CT-1120CR, Part IV, Line 13, minus Part IV, Line 4; or Form CT-990T, Computation of

Amount Payable, Line 5. See instructions. .................................................................................................... 1.

2. Multiply Line 1 by 90% (.90). .......................................................................................................................... 2.

3. Tax from 2012 Form CT-1120 or Form CT-1120U, Schedule C, Line 1, minus Schedule C, Line 1c;

or Form CT-1120CR, Part IV, Line 7, minus Part IV, Line 4; or Form CT-990T, Computation of Amount

Payable, Line 3. See instructions. .................................................................................................................. 3.

4. Multiply Line 3 by 100% (1.00). ...................................................................................................................... 4.

5. Required annual payment: Enter the lesser of Line 2 or Line 4. .................................................................... 5.

Part II – Computation of Required Installments

6. First required installment: Multiply Line 5 by 30% (.30). Enter here and on Part III,

Line 13, Column A, or Part IV, Line 10a. ........................................................................................................ 6.

7. Second required installment: Multiply Line 5 by 40% (.40). Enter here and on Part III,

Line 13, Column B, or Part IV, Line 13c. ........................................................................................................ 7.

8. Third required installment: Multiply Line 5 by 10% (.10). Enter here and on Part III,

Line 13, Column C, or Part IV, Line 16c. ........................................................................................................ 8.

9. Fourth required installment: Multiply Line 5 by 20% (.20). Enter here and on Part III,

Line 13, Column D, or Part IV, Line 19c. ........................................................................................................ 9.

Part III – Annualized Income Installment Schedule

Estimated Payment Calculation

First 2

First 5

First 8

First 11

D

A

B

C

Months

Months

Months

Months

1. Enter your Connecticut corporation business income

for each period. See instructions.

6

2.4

1.5

1.09091

2. Annualization factor

3. Annualized Connecticut corporation business

income: Multiply Line 1 by Line 2.

4. Multiply Line 3 by 7.5% (.075).

5. Enter amounts for surtax and preference tax, if applicable.

6. Add Line 4 and Line 5.

7. Corporation business tax credits: See instructions.

8. Total annualized corporation business tax: Subtract

Line 7 from Line 6.

.27

.63

.72

.90

9. Applicable percentages

10. Multiply Line 8 by Line 9.

11. Add the amounts in all preceding columns of Line 17.

See instructions.

12. Annualized income installment using net income: Subtract

Line 11 from Line 10. If zero or less, enter “0.”

13. Enter your required installment for the period.

See instructions.

14. Enter the amount from Line 16 of the preceding

column of this worksheet.

15. Add Line 13 and Line 14 and enter here.

16. If Line 15 is more than Line 12, subtract Line 12

from Line 15 (otherwise enter “0”).

17. Enter the lesser of Line 12 or Line 15.

18. Total required installment for the period: Add Line 11

and Line 17.

19. Estimated tax payments made through the due date

for the period

20. Estimated tax payment required by the next due

date: Subtract Line 19 from Line 18 and enter the

result, but not less than “0.”

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4