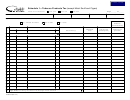

Instructions for Schedule 3—Tax on Oregon Moist Snuff on Units Above Floor

Page 2

Out-of-state filers. Itemize all untaxed moist snuff (definition A) sales in Oregon

Line 2–19. Enter the number of units, wholesale price, and weight (in ounces) of the

for the quarter, including free samples and promotional products you shipped

moist snuff (definition A) eligible for credit as shown on your purchase invoices.

into Oregon.

Line 20. Enter the sum of lines 1 through 19 on each page. Provide a grand total

(of all Schedule 3Bs) on the last page. On line 12, Form 530, enter the grand total

Line 1. Enter zero or the cumulative balances from line 20 of any other

ounces from line 20, column C.

Schedule 3As.

Instructions for sales schedules—Schedule 3C (Form 530 only)

Lines 2–19. These lines have different reporting requirements depending on which

return you must file:

[Only for moist snuff (definition A) you reported, or previously reported, on Schedule 3A]

• Form 530 or Form 531. If you’re a distributor or a consumer, enter the number of

Credit for out-of-state or otherwise exempt sales is reportable in the quarter that the

units, wholesale price, and weight (in ounces) of all the moist snuff (definition

moist snuff physically moves from a distributor. Group all sales by manufacturer

A) shown on your purchase invoices, including amounts reflecting shortages

and provide a moist snuff (definition A) subtotal for each manufacturer.

or overages. If you were shorted merchandise, enter that on Schedule 3B to

Itemize all sales of untaxed moist snuff (definition A) made during the quarter to

claim a credit. If you receive more merchandise than you ordered, enter the

Oregon licensees or shipped out of state. Persons receiving untaxed moist snuff

excess amount on a separate line of the purchase schedule.

(definition A) in Oregon must have the appropriate distributor license to purchase

• Form 532. If you’re a manufacturer, enter the number of units, wholesale price,

untaxed moist snuff (definition A).

and weight (in ounces) of all the moist snuff (definition A) you distributed in

Line 1. Enter zero or the cumulative balances from line 20 of any other

Oregon.

Schedule 3Cs.

Line 20. Enter the sum of lines 1 through 19 on each page. Provide a grand total

Line 2–19. Enter the number of units, wholesale price, and weight (in ounces) of the

(of all Schedule 3As) on the last page. On line 11, Form 530; line 5, Form 531; or

moist snuff (definition A) eligible for credit as shown on your purchase invoices.

line 5, Form 532, enter the grand total ounces from line 20, column C.

Line 20. Enter the sum of lines 1 through 19 on each page. Provide a grand total

Instructions for credit schedules—Schedule 3B (Form 530 only)

(of all Schedule 3Cs) on the last page. On line 13, Form 530, enter the grand total

[Only for moist snuff (definition A) you reported, or previously reported, on Schedule 3A]

of ounces from line 20, column C.

Credits include moist snuff (definition A) that has been purchased but not re-

Questions? Need Help?

ceived on a licensee’s premises (shortages) and damaged merchandise, whether

discovered upon or after receipt. Group all shortages, damaged merchandise,

General tax information . ....................................................

and merchandise returned for credit by manufacturer and provide a moist snuff

Special Programs Admin. Unit ............................................................503-945-8120

(definition A) subtotal for each manufacturer. On the last page of a credit schedule,

Toll-free from an Oregon prefix .......................................................1-800-356-4222

write the total moist snuff (definition A) shorted, damaged, and returned from

Asistencia en español:

all manufacturers.

Salem .......................................................................................................503-378-4988

Enter moist snuff (definition A) received from the manufacturer, found to be short

Gratis de prefijo de Oregon . ..............................................................1-800-356-4222

shipped, lost, or damaged before you received it from a manufacturer. Note on

TTY (hearing or speech impaired; machine only):

papers provided by the carrier any shortages discovered before you received the

Salem .......................................................................................................503-945-8617

merchandise.

Toll-free from an Oregon prefix .......................................................1-800-886-7204

Line 1. Enter zero or the cumulative balances from line 20 of any other

Americans with Disabilities Act (ADA): Call one of the help numbers for infor-

Schedule 3Bs.

mation in alternative formats.

150-605-013 (Rev. 12-11)

1

1 2

2 3

3