or expenses arising from transactions involving intangible prop-

If property had been classified as operational property in

erty, for example corporate stock, or an ownership interest in a

prior periods and is later demonstrated to have been nonopera-

partnership, is operational in nature if the corporation held that

tional and is subsequently disposed of, all expenses, without lim-

intangible or the underlying property represented as an integral

itation, deducted in prior periods related to the nonoperational

or functional component of its trade or business.

property must be added back and recaptured as income in the tax

period of disposition of such property.

The operational test will determine whether intangible

property served an operational rather than an investment func-

If a prior period’s income had been classified as serving an

tion. The relevant inquiry focuses on the objective characteris-

operational function and is later demonstrated not to have been

tics of the intangible property’s acquisition or use and the rela-

serving an operational function, all expenses, without limitation,

tion to the corporation’s overall activities. This test will include

deducted in prior periods related to such income, shall be added

as operational income all other income or gain that the State is

back and recaptured in the year when that occurs.

not prohibited from taxing by the United States Constitution.

General corporate expenses including administrative, taxes,

and interest which cannot be specifically allocated between oper-

Tax Treatment of Nonoperational Activity

ational and nonoperational activity shall be assigned to same by

Expenses are deductible only to the extent that they are con-

the ratio of the average value of assets producing nonoperational

nected with operational property or income. Corporate expenses

income to the average value of the total assets of the corporation.

related to nonoperational income are not deductible at all except

in terms of assigning and taxing income from nonoperational

Only the receipts, property and payroll expenses attributable

activities which have nexus to New Jersey

to operational activity are to be used in computing the three fac-

tor allocation formula.

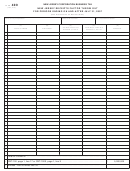

INSTRUCTIONS

and the corporation was charged a processing fee of

SCHEDULE O - PART I

$250.00 on the loan. Both the interest expense ($900)

1. Column A represents Federal Taxable Income before net

and the processing fee ($250) are direct expenses of the

operating loss and special deductions and should be the

asset purchased and should be included in the

same amount as reported on Schedule A, Form CBT-100. If

Nonoperational Column (Column B).

Form CBT-100S is being filed, the adjustments made to con-

vert S Corporation income to C Corporation income should

Example 2 - Indirect Expenses

be interpolated to the corresponding lines of this schedule.

Corporation C has a substantial cash flow to the point

that it maintains a separate division to manage and con-

2. Column C represents total operational activity that will be

trol all of its excess funds (both operational and claimed

apportioned to all taxing jurisdictions using the business

nonoperational funds). Corporation C should assign the

allocation factor. Columns B and C should always total to

direct expenses associated with the nonoperational

Column A with respect to lines 1 through 28.

assets and apportion the remaining indirect divisional

expenses on a reasonable basis (e.g., value of opera-

3. Column B represents total nonoperational income, gains,

tional assets to nonoperational assets), and apportion

losses and attributable expenses which are not apportioned

part of the corporate overhead on some reasonable basis

but are specifically assigned. The income and expense items

(e.g., value of the part of the division to the total corpo-

must be related to assets declared on Schedule O - Part II.

ration).

a. Line 4 through Line 11 reflect the revenues, gains or

losses generated by nonoperational assets.

Indirect corporate expenses, including general and

administrative expenses, interest expenses and taxes,

b. Line 12 through Line 27 reflect the direct and indirect

shall be assigned to nonoperational assets by the ratio of

expenses associated with the nonoperational assets.

the average value of assets producing nonoperational

Submit a statement detailing the basis and the account-

income to the average value of the total assets of the

ing controls employed in assigning direct and indirect

corporation.

expenses to the nonoperational assets.

c. Lines 29(a) and (b) reflect the financial activity of non-

Example 1 - Direct Expenses

operational tax exempt assets and operational tax

Corporation A, a manufacturer of shoes, purchased

exempt assets.

1,000 shares of stock of Corporation B, a car wash com-

pany located outside New Jersey, for $15,000 as a pas-

d. Line 30(a) reflects the net income from nonoperational

sive investment which it claims is a nonoperational

activities. It is the total of line 28 plus line 29(a) minus

asset. Corporation A purchased these shares by borrow-

line 29(b). The total from this line should be carried to

ing $10,000 at a 9% interest rate, and by utilizing excess

Page 1, line 4(a) of Form CBT-100.

funds of $5,000. The first year’s interest was $900.00,

- 2 -

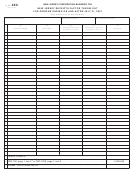

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8