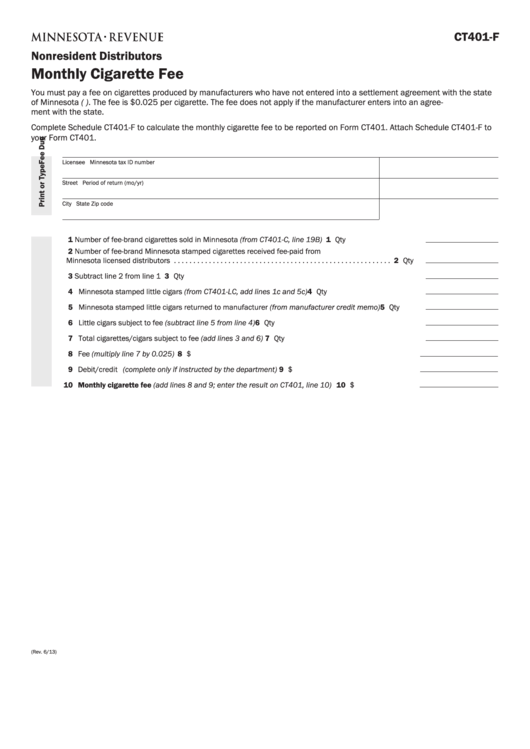

CT401-F

Nonresident Distributors

Monthly Cigarette Fee

You must pay a fee on cigarettes produced by manufacturers who have not entered into a settlement agreement with the state

of Minnesota (M.S. 297F.24) . The fee is $0 .025 per cigarette . The fee does not apply if the manufacturer enters into an agree-

ment with the state .

Complete Schedule CT401-F to calculate the monthly cigarette fee to be reported on Form CT401 . Attach Schedule CT401-F to

your Form CT401 .

Licensee

Minnesota tax ID number

Street

Period of return (mo/yr)

City

State

Zip code

1 Number of fee-brand cigarettes sold in Minnesota (from CT401-C, line 19B) . . . . . . . . . . . . . . . . . . . 1 Qty

2 Number of fee-brand Minnesota stamped cigarettes received fee-paid from

Minnesota licensed distributors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 Qty

3 Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 Qty

4 Minnesota stamped little cigars (from CT401-LC, add lines 1c and 5c) . . . . . . . . . . . . . . . . . . . . . . . . . . 4 Qty

5 Minnesota stamped little cigars returned to manufacturer (from manufacturer credit memo) . . . . . . . 5 Qty

6 Little cigars subject to fee (subtract line 5 from line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 Qty

7 Total cigarettes/cigars subject to fee (add lines 3 and 6) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Qty

8 Fee (multiply line 7 by 0.025) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 $

9 Debit/credit (complete only if instructed by the department) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 $

10 Monthly cigarette fee (add lines 8 and 9; enter the result on CT401, line 10) . . . . . . . . . . . . . . . . . 10 $

(Rev . 6/13)

1

1