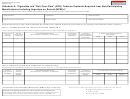

INSTRUCTIONS FOR SCHEDULE MSA-RYO-3a and MSA-RYO-3b (TB-34)

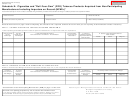

Column G: Enter the number of ounces of NPM RYO sold in Kansas during the reporting

As part of the Master Settlement Agreement between certain cigarette manufacturers and

the State of Kansas, the Department of Revenue is required to compile information about

month by brand. List only ounces of NPM RYO on which you paid the Kansas excise tax

cigarettes and roll-your-own (RYO) tobacco sold in Kansas that is manufactured or

and for which you are not eligible to receive a refund or credit from the Department of

imported by manufacturers who do not participate in the Master Settlement Agreement

Revenue.

(Non-Participating Manufacturers). The Department of Revenue will provide this

Column H: Enter the full name and address (including street, city, state and zip code) of

information to the Kansas Attorney General for use in enforcing the law.

the NPM who manufactured the RYO brand transacted.

Complete this schedule and submit it on or before the 20th day of each month, along with

your monthly excise tax report, if you are an in-state licensed tobacco products distributor.

Column I: Enter the number of ounces of NPM RYO sold into other states during the

If you are an out-of-state licensed tobacco products distributor, please complete Schedule

reporting month by brand, for which you will receive a refund or credit.

MSA-RYO-2.

Column J: Enter the number of ounces of NPM RYO returned to the manufacturer during

Complete this schedule as required in full, even if you had no activity during the filing

the reporting month by brand, for which you will receive a refund or credit.

period. If you had no activity, please check the designated box on the schedule.

Column K: Enter the number of ounces of NPM RYO destroyed during the reporting

Preparation of Schedule:

month by brand, for which you will receive a refund or credit.

ƒ

Check the box indicating whether this is an “Original Report” or an “Amended

Report.”

Completion of Schedule:

ƒ

ƒ

Enter your full name and address (including street, city, state and zip code).

Use supplemental schedules if necessary. You may photocopy this schedule if you

ƒ

Enter your Kansas distributor license number.

require additional space.

ƒ

ƒ

Enter the month and year covered by this report.

Sign and date the schedule declaring that the information listed is true and correct.

ƒ

Print your name and title.

ƒ

Column A: Enter the full brand family name of the NPM RYO product purchased. Do not

Enter the page number and total number of pages included in the completion of

abbreviate. Do not break down into sub-categories, such as regular, menthol, light, etc.

this schedule.

ƒ

Visit for a current list of manufacturers and brands certified for sale

Retain a copy of this schedule for your files.

ƒ

in Kansas.

Include this completed schedule with your monthly excise tax report and mail to:

Miscellaneous Tax

Column B: Enter the number of ounces of NPM RYO brought into Kansas during the

Kansas Department of Revenue

reporting month for each brand. List only ounces of NPM RYO for which you paid the

915 SW Harrison St.

Kansas excise tax.

Topeka, Kansas 66612-1588

Column C: Enter the full name and address (including street, city, state and zip code) of

This schedule is for reporting purposes only. It is not used for the calculation of tax.

the NPM who manufactured the RYO brand purchased.

For assistance in completing this schedule, please contact the Department of Revenue at

Column D: Enter the full name and address (including street, city, state and zip code) of

785-368-8222.

the supplier from whom you originally purchased the RYO brand if different from the NPM

identified in Column C.

FAILURE TO FILE YOUR MONTHLY REPORT AS REQUIRED BY LAW MAY RESULT

IN THE SUSPENSION OR REVOCATION OF YOUR DISTRIBUTOR’S LICENSE FOR A

Column E: Enter the full name and address (including street, city, state and zip code) of

PERIOD UP TO ONE YEAR AND A MAXIMUM ADMINISTRATIVE FINE OF $1,000

the first importer of any RYO brand manufactured outside of the United States.

FOR EACH VIOLATION.

Column F: Enter the full brand family name of the NPM RYO product transacted during

the reporting month. Do not abbreviate. Do not break down into sub-categories, such as

regular, menthol, light, etc.

You may obtain additional copies of this schedule by visiting the Department of Revenue’s website at:

1

1 2

2 3

3