KANSAS R

etailers’

S

T

R

ales

ax

eturn

Form ST-36

(Rev. 11/13)

LINE 5 - If your filing frequency is prepaid monthly, enter

Tired of paper

the estimated amount from line 4 of last month’s return.

and postage?

LINE 6 - Add lines 3 and 4, and subtract line 5. Enter the

Use KS WebTax, a quick, easy, smart way to get your

result on line 6.

Business Taxes where you want them to be - DONE!

LINE 7 - Enter the amount of the credit memorandum

Visit to log-in.

issued by the Kansas Department of Revenue.

If you are filing an amended return,

GENERAL INFORMATION

enter in the total amount previously

paid for this filing period.

• The due date is the 25

th

day of the month following the

ending date of this return.

LINE 8 - Subtract line 7 from line 6 and enter result on line 8.

• Keep a copy of your return for your records.

LINE 9 - If filing a late return, enter the amount of penalty

due. Penalty rate information is on our web site (see

• You must file a return even if there were no taxable sales.

Taxpayer Assistance on the back of this form).

• Write your Tax Account Number on your check or money

LINE 10 - If filing a late return, enter the amount of interest

order and make payable to Retailers’ Sales Tax. Send

due. Interest rate information is on our web site (see

your return and payment to: Kansas Department of

Taxpayer Assistance on the back of this form).

Revenue, 915 SW Harrison St., Topeka, KS 66612-1588.

LINE 11 - Add lines 8, 9, and 10 and enter result on line 11.

You must complete Part II, Part III, and Part IV, as

PART I –

applicable, before completing Part I.

PART II (Deductions)

LINE 1 - Enter the total tax from Part III, line 10.

Complete lines A through N, if appropriate, and enter the

LINE 2 - Enter the total net tax deduction from Part IV,

total deductions on line O. Other allowable deductions must

line 7. (Utility Retailers Only)

be itemized. Use a separate schedule if necessary.

LINE 3 - Subtract line 2 from line 1and enter result on line 3.

PART III (Location Breakdown)

Â

If your filing frequency is prepaid monthly, lines 4 and 5

If additional room is needed, complete Part III

must be completed.

Supplement Schedule.

Â

If your filing frequency is not prepaid monthly, skip lines 4

Taxing Jurisdiction - If the tax jurisdiction is not complete

and 5 and proceed to line 6.

or is incorrect, enter the name of the city, county and

LINE 4 - If your filing frequency is prepaid monthly, enter

jurisdiction code in which tax is due.

the estimated amount of tax due for the following

Column 1 - Enter the jurisdiction code that coincides with

calendar month. A retailer whose total tax liability

the name of the city/county where tax is collected. (Refer

exceeds $32,000 in any calendar year is required to pay

to your Jurisdiction Code Booklet.)

the sales tax liability for the first 15 days of each month

Column 2 - Enter the gross receipts or sales during the

th

on or before the 25

day of that month. A retailer will be

period, both taxable and non-taxable. DO NOT include

in compliance with this requirement if, on or before the

the sales taxes collected in this figure.

25

th

day of the month, the retailer paid 90% of the liability

of that 15 day period, or 50% of the tax liability for the

Column 3 - Enter your cost of tangible personal property

same month of the previous year. DO NOT ENTER AN

consumed or used by you that was purchased without

AMOUNT LESS THAN ZERO.

tax.

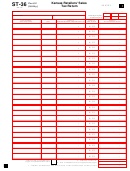

1

1 2

2 3

3 4

4 5

5 6

6