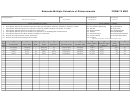

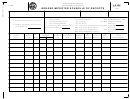

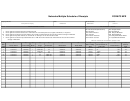

Form 73 Mfr - Nebraska Multiple Schedule Of Receipts Page 3

ADVERTISEMENT

Dyed diesel is not subject to the motor fuels tax; however, the Petroleum Release Remedial Action Fee

(PRF) does apply to dyed diesel. By reporting the dyed diesel on this schedule, the PRF is automatically

calculated. Motor fuels tax is not calculated on the dyed diesel.

Schedule Codes 2A and 4 are unique to this return.

Schedule Code 2A – Use this schedule code to report the Nebraska purchase of ethanol that you

placed into Nebraska terminal storage. The IRS terminal code must be reported as the destination.

These transactions will not affect the face of the return and will not be part of the calculation of

tax. A corresponding disbursement for this transaction is not reported since this schedule code

indicates a terminal as a destination.

Schedule Code 4 – Use this schedule code to report the import of ethanol that you placed into

Nebraska terminal inventory. The IRS terminal code must be reported as the destination. These

transactions will not affect the face of the return and will not be part of the calculation of tax. A

corresponding disbursement for this transaction is not reported since this schedule code indicates

a terminal as a destination.

Valid Federal Employee Identification Numbers (FEINs) must be used for all fuel transfers in Nebraska.

Nebraska licensees and their correct FEINs are listed under Licensees.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3