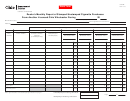

CIG 59

Instructions for Completing Dealer’s Monthly Report of Unstamped Cigarette Purchases

Rev. 3/09

Page 2

Received From Licensed Manufacturers or Importers in Ohio

Header

Complete all information.

those cigarettes actually received. The back order should then be recorded on

the date received, using the invoice number to which the back order applies.

Column 1

Enter date cigarettes are received.

Each column should be totaled by manufacturer or importer and the total entered

Enter manufacturer’s invoice number. Care should be taken not

Column 2

on the “Page Total” line at the bottom of the report. If only one page is required for

the month, the “Summary Total” will be the same as the “Page Total.” If more

to erroneously enter bill of lading, standing order number,

than one page is used, page totals should be summarized by manufacturer or

purchase order number, or any number other than the invoice

importer and the summary tot a l entered on the “Summary Total” line of the last

number.

page of the report for unstamped receipts.

Column 3

Enter the name of the manufacturer or importer in the header,

through 8 then enter the number of unstamped cigarettes received

through 8

Summary totals for the month should be combined and the result inserted in the

from the manufacturer or importer you have purchased cigarettes

Grand Total box.Grand totals for the proper months should then be combined

from in the appropriate columns. Purchases of stamped cigarettes

and the result inserted on line 13 of the semiannual Ohio cigarette tax return.

must be reported on a CIG-59A.

In the event you have not received cigarettes during the month covered by the

The receipts should be entered daily with a separate line used for each invoice .

report, please complete the upper portion of the form and insert the word “NONE”

on the first line of Column 1. A report is required for every month the account is

Only those cigarettes actually received during the month covered by the

active.

report should be recorded. In the case of a short shipment, record only

This report must be completed and filed even if no cigarettes were received unstamped

from a licensed manufacturer/importer during the month.

1

1 2

2