Form 512 - Schedule A - 2012

Download a blank fillable Form 512 - Schedule A - 2012 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 512 - Schedule A - 2012 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset Form

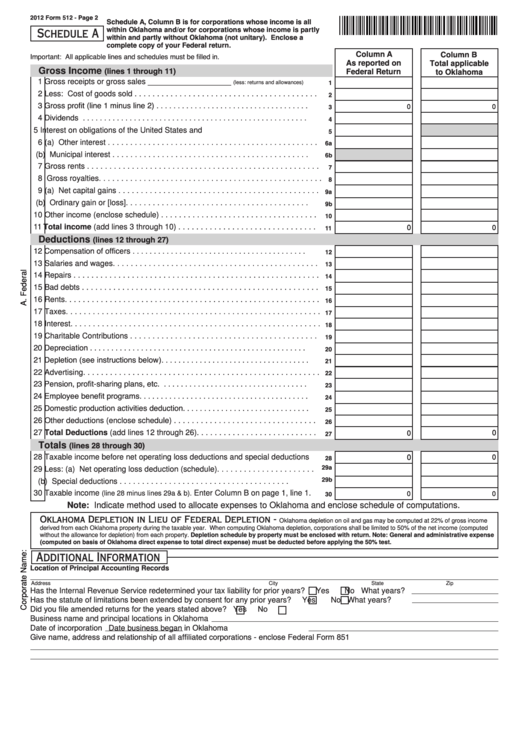

2012 Form 512 - Page 2

Schedule A, Column B is for corporations whose income is all

Schedule A

within Oklahoma and/or for corporations whose income is partly

within and partly without Oklahoma (not unitary). Enclose a

complete copy of your Federal return.

Column B

Important: All applicable lines and schedules must be filled in.

Column A

As reported on

Total applicable

(lines 1 through 11)

Gross Income

Federal Return

to Oklahoma

1

1

Gross receipts or gross sales ___________________

....

(less: returns and allowances)

2

2

Less: Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Gross profit (line 1 minus line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

0

0

4

Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

Interest on obligations of the United States and U.S. Instrumentalities . . . . . .

5

6a

6

(a) Other interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6b

(b) Municipal interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7

Gross rents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

8

Gross royalties. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

(a) Net capital gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9a

(b) Ordinary gain or [loss]. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9b

10

10

Other income (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

11

Total income (add lines 3 through 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

0

0

(lines 12 through 27)

Deductions

12

Compensation of officers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13

13

Salaries and wages. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

14

Repairs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

15

Bad debts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

16

Rents. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

17

Taxes. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

18

Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

19

Charitable Contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

21

Depletion (see instructions below). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22

22

Advertising. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

Pension, profit-sharing plans, etc. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24

Employee benefit programs. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25

Domestic production activities deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25

26

26

Other deductions (enclose schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

27

Total Deductions (add lines 12 through 26). . . . . . . . . . . . . . . . . . . . . . . . . . .

0

0

(lines 28 through 30)

Totals

28

28

Taxable income before net operating loss deductions and special deductions

0

0

29a

29

Less: (a) Net operating loss deduction (schedule). . . . . . . . . . . . . . . . . . . . . .

29b

(b) Special deductions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

30

30

Taxable income

Enter Column B on page 1, line 1.

(line 28 minus lines 29a & b).

0

0

Note: Indicate method used to allocate expenses to Oklahoma and enclose schedule of computations.

Oklahoma Depletion in Lieu of Federal Depletion -

Oklahoma depletion on oil and gas may be computed at 22% of gross income

derived from each Oklahoma property during the taxable year. When computing Oklahoma depletion, corporations shall be limited to 50% of the net income (computed

without the allowance for depletion) from each property. Depletion schedule by property must be enclosed with return. Note: General and administrative expense

(computed on basis of Oklahoma direct expense to total direct expense) must be deducted before applying the 50% test.

Additional Information

Location of Principal Accounting Records

Address

City

State

Zip

Has the Internal Revenue Service redetermined your tax liability for prior years?

Yes

No What years?

Has the statute of limitations been extended by consent for any prior years?

Yes

No What years?

Did you file amended returns for the years stated above?

Yes

No

Business name and principal locations in Oklahoma

Date of incorporation

Date business began in Oklahoma

Give name, address and relationship of all affiliated corporations - enclose Federal Form 851

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3