Instructions For 2013 Permittee Annual Financial Statement-Ez

ADVERTISEMENT

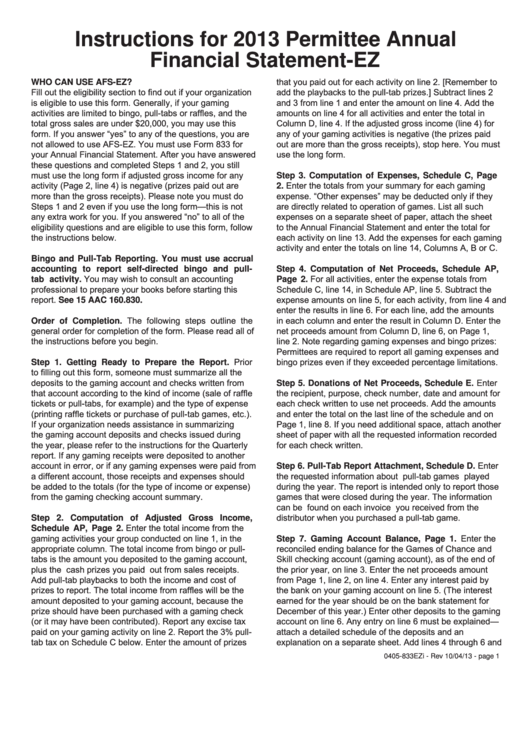

Instructions for 2013 Permittee Annual

Financial Statement-EZ

WHO CAN USE AFS-EZ?

that you paid out for each activity on line 2. [Remember to

Fill out the eligibility section to find out if your organization

add the playbacks to the pull-tab prizes.] Subtract lines 2

is eligible to use this form. Generally, if your gaming

and 3 from line 1 and enter the amount on line 4. Add the

activities are limited to bingo, pull-tabs or raffles, and the

amounts on line 4 for all activities and enter the total in

total gross sales are under $20,000, you may use this

Column D, line 4. If the adjusted gross income (line 4) for

form. If you answer “yes” to any of the questions, you are

any of your gaming activities is negative (the prizes paid

not allowed to use AFS-EZ. You must use Form 833 for

out are more than the gross receipts), stop here. You must

your Annual Financial Statement. After you have answered

use the long form.

these questions and completed Steps 1 and 2, you still

must use the long form if adjusted gross income for any

Step 3. Computation of Expenses, Schedule C, Page

activity (Page 2, line 4) is negative (prizes paid out are

2. Enter the totals from your summary for each gaming

more than the gross receipts). Please note you must do

expense. “Other expenses” may be deducted only if they

Steps 1 and 2 even if you use the long form—this is not

are directly related to operation of games. List all such

any extra work for you. If you answered “no” to all of the

expenses on a separate sheet of paper, attach the sheet

eligibility questions and are eligible to use this form, follow

to the Annual Financial Statement and enter the total for

the instructions below.

each activity on line 13. Add the expenses for each gaming

activity and enter the totals on line 14, Columns A, B or C.

Bingo and Pull-Tab Reporting. You must use accrual

accounting to report self-directed bingo and pull-

Step 4. Computation of Net Proceeds, Schedule AP,

tab activity. You may wish to consult an accounting

Page 2. For all activities, enter the expense totals from

professional to prepare your books before starting this

Schedule C, line 14, in Schedule AP, line 5. Subtract the

report. See 15 AAC 160.830.

expense amounts on line 5, for each activity, from line 4 and

enter the results in line 6. For each line, add the amounts

Order of Completion. The following steps outline the

in each column and enter the result in Column D. Enter the

general order for completion of the form. Please read all of

net proceeds amount from Column D, line 6, on Page 1,

the instructions before you begin.

line 2. Note regarding gaming expenses and bingo prizes:

Permittees are required to report all gaming expenses and

Step 1. Getting Ready to Prepare the Report. Prior

bingo prizes even if they exceeded percentage limitations.

to filling out this form, someone must summarize all the

deposits to the gaming account and checks written from

Step 5. Donations of Net Proceeds, Schedule E. Enter

that account according to the kind of income (sale of raffle

the recipient, purpose, check number, date and amount for

tickets or pull-tabs, for example) and the type of expense

each check written to use net proceeds. Add the amounts

(printing raffle tickets or purchase of pull-tab games, etc.).

and enter the total on the last line of the schedule and on

If your organization needs assistance in summarizing

Page 1, line 8. If you need additional space, attach another

the gaming account deposits and checks issued during

sheet of paper with all the requested information recorded

the year, please refer to the instructions for the Quarterly

for each check written.

report. If any gaming receipts were deposited to another

account in error, or if any gaming expenses were paid from

Step 6. Pull-Tab Report Attachment, Schedule D. Enter

a different account, those receipts and expenses should

the requested information about pull-tab games played

be added to the totals (for the type of income or expense)

during the year. The report is intended only to report those

from the gaming checking account summary.

games that were closed during the year. The information

can be found on each invoice you received from the

Step 2. Computation of Adjusted Gross Income,

distributor when you purchased a pull-tab game.

Schedule AP, Page 2. Enter the total income from the

Step 7. Gaming Account Balance, Page 1. Enter the

gaming activities your group conducted on line 1, in the

appropriate column. The total income from bingo or pull-

reconciled ending balance for the Games of Chance and

tabs is the amount you deposited to the gaming account,

Skill checking account (gaming account), as of the end of

plus the cash prizes you paid out from sales receipts.

the prior year, on line 3. Enter the net proceeds amount

Add pull-tab playbacks to both the income and cost of

from Page 1, line 2, on line 4. Enter any interest paid by

prizes to report. The total income from raffles will be the

the bank on your gaming account on line 5. (The interest

amount deposited to your gaming account, because the

earned for the year should be on the bank statement for

prize should have been purchased with a gaming check

December of this year.) Enter other deposits to the gaming

(or it may have been contributed). Report any excise tax

account on line 6. Any entry on line 6 must be explained—

paid on your gaming activity on line 2. Report the 3% pull-

attach a detailed schedule of the deposits and an

tab tax on Schedule C below. Enter the amount of prizes

explanation on a separate sheet. Add lines 4 through 6 and

0405-833EZi - Rev 10/04/13 - page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2